Abstract

China’s banking sector is dominated by four distinct organizational forms: policy banks (PBs), state-owned commercial banks (SOCBs), joint stock commercial banks (JSCBs), and rural credit cooperatives (RCCs). Economic analyses have especially focused on the development of bank efficiency and profitability over time. The equally important question, which of China’s banking institutions promote economic growth, has not been explored using macroeconomic data. Our study uses a novel data set covering the period 1997–2008 and employs Granger causality tests to estimate the finance–growth nexus of each of these bank types. Our results show that SOCBs and RCCs do not Granger-cause GDP growth and that SOCBs even have a negative effect on manufacturing growth. By contrast, PBs and JSCBs promote economic growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Populist accounts of China’s development model often refer to government-sponsored “superbanks” as the engine of the country’s growth model (Sanderson and Forsythe 2013). This perspective mirrors theoretical arguments in support of a developmental role of government-owned banks as a ready tool politicians can use to channel household savings into productive investment opportunities that would otherwise be missed by private banking institutions (Hausmann and Rodrik 2003; Andrianova et al. 2008).Footnote 1 Specific advantages associated with government-owned banks include an increase in social welfare and economic development (Stiglitz 1994), employment for the poor (Banerjee 2003; Burgess and Pande 2005), limited risk taking on the part of bank managers (Demirgüc-Kunt and Detragiache 1998), and a closer interest alignment with central banks, allowing for more effective monetary policy interventions (Micco and Panizza 2006; Yeyati et al. 2007).

Notwithstanding, government-owned banks are not without risks. Theoretical and empirical evidence shows that politicians often interfere in lending decisions to pursue political and personal interests instead of economic goals (Shleifer and Vishny 1998; Shen and Lin 2012), leading to the crowding-out of credit to more productive firms (Sapienza 2004). As China’s example shows, it is often particularly politically unconnected private firms that lack access to the politically controlled banking system and credit allocation (Nee and Opper 2010, 2012). Historically, the financing of state-sponsored pet projects has also contributed to the accumulation of non-performing loans (Heremans and Pacces 2012). Tight government regulation and supervision also opens up opportunities for rent-seeking activities, corruption, and elite capture (Barth et al. 2004; Morck et al. 2011).Footnote 2 These problems are reinforced by standard problems of corporate governance and soft budget constraints, which are commonly observed for state-owned firms in manufacturing and service sectors (Shleifer 1998; Dewenter and Malatesta 2001).

Clearly, identifying the nature of the finance–growth nexus of China’s government-dominated banking system is crucial to understand the country’s growth model (Aziz and Duenwald 2002; Boyreau-Debray 2003; Liang and Teng 2006; Hao 2006; Rousseau and Xiao 2007; Hasan et al. 2009; Cheng and Degryse 2010). Earlier work, however, has largely neglected the organizational heterogeneity of China’s banking sector, consisting of an increasingly diversified financial system combining fully state-owned policy banks (PBs) with state-commercial banks with majority state ownership (SOCBs), joint stock banks with minority state shares (JSCBs), and collectively owned rural credit cooperatives (RCCs). Microlevel studies highlight differences in profitability and efficiency among these different banking institutions (Ariff and Can 2008; Berger et al. 2009; Matthews and Zhang 2010; Chang et al. 2012). We take these findings as our point of departure to explore China’s finance–growth nexus by treating each organizational segment of the banking industry as an aggregate measure responsible for one share in China’s lending portfolio. Using Granger causality tests and a factor model separating idiosyncratic lending decisions from common shocks, we analyze the growth effects of total, short-term, and long-term loans on a set of different macroeconomic variables for the period from 1997 to 2008.

Our results show that only traditional policy banks and partly state-owned joint stock commercial banks are growth-promoting. Lending by the dominant state-owned commercial banks, which still hold more than 50 % of loans and assets, dampens growth in the short run. Moreover, the lending activities of rural credit cooperatives are negatively related to growth. Overall, our results underline the importance of a more fine-grained approach to the study of the finance and growth nexus of distinct state-controlled banking institutions. Institutional and functional features apparently combine to shape different lending strategies, which do not invite general conclusions.

The remainder of the paper is organized as follows. Section 2 provides a summary account of China’s banking sector. Given the extensive literature on various banking institutions (Garcia-Herrero et al. 2006; García-Herrero et al. 2009; Berger et al. 2009; Cousin 2011), here we only briefly sketch the major institutional and functional differences among the four most important banks included in our analysis. Section 3 describes our data and methodology. Section 4 moves on to the empirical analysis and a discussion of the observed finance–growth effects, and Section 5 presents the study’s conclusions.

2 Organizational diversity in China’s banking sector

The banking sector is the predominant channel of financing investment in China. Between 1997 and 2005 alone, bank lending grew by 260 % in real terms, underscoring the capital-driven development model pursued by Chinese politicians. While the government launched substantial reforms following the dissolution of the monobank system in 1980, gradually leading to the emergence of a highly diversified financial sector (see Table 1), state control, exercised through state and public ownership, remained a prerogative.

Our focus is on the four most important organizational forms in terms of lending shares, which by the end of our observation period in 2008 added up to 85 % of the total loans (Almanac of China’s Finance and Banking 2009). Fully state-owned policy banks (PBs)Footnote 3, instituted in 1994, are in charge of policy lending and focus on large-scale capital construction projects, typically in the range of 0.5–10 billion CNY. State-owned commercial banks (SOCBs) have operated as political lenders throughout the entire reform period (Cull and Xu 2003). In 2005, the first public offering of an SOCB introduced a period of partial privatization to improve corporate governance mechanisms and internal risk management (see Cousin 2011; Berger et al. 2009), although state-owned majority shares still guarantee continuing political control and interference.Footnote 4 Joint stock commercial banks (JSCBs) are the youngest organizational type under review here and are—with only few exceptions—characterized by relatively modest state shareholdings between 15 and 25 % (see Online Appendix A for detail) and face—unlike SOCBs—substantial bankruptcy and takeover risk (Lin and Zhang 2009).Footnote 5 Finally, rural credit cooperatives (RCCs) are collectively run banks, registered as independent legal persons and designed to support local activities in rural China (Garcia-Herrero et al. 2006; Gao 2012; Shen et al. 2009). A comparison of the distinct lending strategies shows that all commercial banks favor short-term loans with maturities of up to one year. Such short-term loans are predominantly used to bypass liquidity constraints and finance working capital. Only SOCBs have a substantial proportion of medium-term loans, representing 40.7 % of their loan portfolios (see Table 2).

Table 3 summarizes cross-organizational differences with respect to ownership, political independence, budget constraints, and functional characteristics. Institutionally, JSCBs and RCCs should enjoy stronger profit incentives and greater operational autonomy. Functionally, however, the local market limitations of RCCs may well outweigh these advantages. PBs and SOCBs come closest to the standard model of government-owned banks characterized by limited operational autonomy and intense political interference (Shleifer and Vishny 1998). PBs and SOCBs (prior to their public listing in 2005) also enjoy comparatively soft budget constraints, which suggest the existence of standard problems of corporate governance and weaker profit incentives. Nevertheless, the implications for the finance–growth nexus may well differ between both banks given the different types of loans (political versus commercial) granted and a different mix of central and local involvement over time. Our working hypothesis is that the organizational, institutional, and functional diversity of state banking is associated with different effects on economic growth. If confirmed, our findings provide the empirical grounds for a more nuanced debate on the growth effect of government-owned banks, not only in China but as a policy instrument in general.

3 Empirical strategy

3.1 Method

In the finance–growth literature, the causal relationship between bank lending and economic growth is commonly tested using Granger causality tests (see, e.g., Rousseau and Wachtel 1998; Gries et al. 2009; Rousseau and D’Onofrio 2013). The Granger causality test is not a causality test in a strict sense because it cannot, in its simplest form, detect instantaneous causality (for a detailed discussion, see, e.g., Granger 1969). The test may also yield spurious results if both variables respond to a common shock and the responses to the shock are staggered. The test, therefore, only reveals causal effects under certain restrictions (see, e.g., Granger 1969; Sims 1972).

These restrictions are unlikely to have any substantial effect on the power of the test in this study. Although there is an ongoing debate on the question of whether bank lending influences growth, or vice versa (see, e.g., Yilmazkuday 2011), there is no strong indication to assume simultaneous lending and growth effects. Time lags between both effects represent the standard behavioral response pattern. Once an investor receives a loan, contracts must be signed and projects need to be initiated. Possible efficiency gains from improved resource allocation are thus likely to occur in future periods. Similarly, assuming causality runs from growth to lending, investors typically respond to increased economic growth with a distinct time lag because companies rarely operate at full capacity and investors want to be certain not to prematurely respond to short-term peaks in demand. Although one can construct cases in which growth and lending can occur simultaneously, these cases do not represent the standard responses of banks and investors. Therefore, despite their weaknesses, Granger causality tests offer an appropriate tool for exploring the finance–growth nexus.Footnote 6

We use two sets of Granger causality tests to explore the causal relationship between lending and growth. One set of tests explores the short-run causal relationship, and the other explores the long-run causal relationship. Differentiating between the short- and long-run Granger causal relationships is important because we do not have information regarding the objective functions state banks and their principals apply. Clearly, the quality and timing of a potential finance–growth nexus depends on the question of whether state banks aim to pursue strategic, long-term goals (which may not result in an immediate response in terms of growth promotion) or respond to social, economic, and political needs with a focus on short-term effects.

The long-run growth causal effects are explored using the Toda and Yamamoto (1995) test. This test is an extension of the original Granger causality tests for non-stationary data. The test is based on a similar VAR representation as the original tests but includes additional lags to take into account the time series non-stationarity; the number of additional lags is based on the integration order of the time series. The strength of the test is that it can be applied to non-stationary data while “paying little attention to the integration and cointegration properties of the time series data in hand” (Toda and Yamamoto 1995). An alternative to the Toda and Yamamoto test is to use a vector error correction model (VECM). But, in a small sample such as ours, the VAR models offer more reliable results than the VECMs (Naka and Tufte 1997), and the VAR model in general performs well in explaining relationships between various macroeconomic variables and has been commonly used in studies of the finance–growth nexus (Demetriades and Hussein 1996; Kamin and Rogers 2000; Rousseau and Vuthipadadorn 2005; Gündüz and Kaya 2014). As a sensitivity test, however, we also test whether the series are cointegrated using the Johansen cointegration method. Cointegration implies that there is a causal relationship, whereby we can use the cointegration test to confirm the results from the Toda and Yamamoto test. It is important to note that it is not necessary for the series to be cointegrated for there to be a causal relationship (Toda and Yamamoto 1995). Even if we find no cointegration, a causal relationship may still exist. The results from the Johansen cointegration test are available in Online Appendix B. Overall, the cointegration results confirm the results from the Toda and Yamamoto test.

The short-run causal relationship is explored using first differenced data and the original Granger causality test. Because we have taken the logarithm of all the time series, taking the first difference thus gives us the log-growth rate. The number of lags included in the test regressions is determined using the Bayesian information criterion.Footnote 7

A potential problem with the Granger causality tests is that the tests assume strict exogeneity of the independent variables. State involvement, for example, by monetary policy interventions, or business cycle fluctuations may equally affect bank lending and growth. Such joint shocks can lead to spurious conclusions regarding the causal relationship unless they are controlled for in the test. To control for joint shocks, we decompose the data into an idiosyncratic component and a common factor using a factor model. The common factor is an estimate of the joint shocks, for example business cycles and monetary policy decisions. The idiosyncratic component captures changes in lending that are unique for each bank type and thus represents variations in lending caused by the respective bank type’s individual lending decisions (Dave et al. 2013). An alternative to the factor model is to control for the common shocks by including additional variables such as macroeconomic and policy variables in the test regressions. This strategy, however, poses the risk of omitting an important variable, and it quickly reduces the number of degrees of freedom. We therefore use the factor model to control for joint shocks.

Our method to control for common shocks can introduce measurement errors, which in turn may affect our Granger causality tests (see, e.g., Andersson 2005). As a sensitivity check, we have therefore also carried out Granger causality tests using the original data. In most cases, the results are the same for the original data and the decomposed data, and confirm our overall conclusion on the effect of ownership on growth promotion. Where differences occur, these are generally explained by joint shocks affecting bank lending. Any potential measurement error introduced by the use of a factor model is therefore likely to be small and unlikely to affect our results. A discussion of how the Granger causality tests are affected by the use of the factor model is offered in Online Appendix B where we also show the results of the causality tests on the original non-decomposed data.

Specifically, using the factor model, lending is decomposed as follows:

where b denotes the bank type, m denotes the loan type (total loans, short-term loans, or long-term loans), f is the common factor, \(\theta _{{bm1}}\) are the factor loadings, and z is the idiosyncratic component. Having estimated the common component (f) and the loadings, we then estimate the idiosyncratic component \(\hat{z}\) as follows:

where \(\hat{\theta }_{{bm}0} \) and \(\hat{\theta }_{{bm}1} \) are the estimated parameters, and \(\hat{f}_{{mt}} \) is the estimated common factor. We then perform Granger causality tests based on vector autoregressive (VAR) models using the idiosyncratic bank lending component, z. The common factor and the factor loadings are estimated using principal component analysis following the approach by Bai and Ng (2004). This method allows the factor to be both dynamic and potentially non-stationary.

The short-run test regressions are given by

where \(x_{{it}}\) is growth in the real economy, and \(l_{{bt}}\) is the idiosyncratic growth rate in a real bank lending from bank type b that has been estimated using (2). The causal relationship is tested by testing whether \(\beta _{ij} =0\) for all \(j=1,{\ldots },J\) and/or \(a_{bh} =0\) for all \(h=1,{\ldots },H\). Because we use growth rates, these tests explore the short-run relationship.

The Toda and Yamamoto’s (1995) modified Granger causality is similar to the test described by Eqs. (3) and (4), but additional lags of the dependent and the explanatory variables are added to the regression models to control for non-stationarity. These tests are based on estimating the two test regressions,

where \(X_{{it}}\) is the logarithm of the real economic measure in levels, and \(L_{{bt}}\) is the logarithm of idiosyncratic real bank lending in levels. To control for the non-stationarity, D additional lags of the dependent and explanatory variables are added to the test regression, where D is equal to the integration order of the respective variables. That is, if X and L are integrated of order 1, one additional lag of these variables is included in the test regressions. The causal relationship is tested as in the stationary case by testing whether \(b_{ij} =0\) for all j and \(a_{{bh}} =0\) for all h.

3.2 Data

We consider three different measures of bank loans: total, short-term, and long-term loans. The differentiation between short- and long-term loans is important because short-term loans may be more plagued by ad hoc political intervention at the local level. Reportedly, government officials in China are careful to avoid the social unrest often associated with rising local unemployment levels. It has been observed, for instance, that the employment policies of state-owned companies follow a countercyclical pattern, hinting at political interference to maintain surplus employment during economic downturns (Hu et al. 2006). The inclination for politicians and firms to lobby for short-term liquidity loans is therefore more pronounced. Long-term loans, in contrast, are more likely to reflect strategic political interests and government-mandated development plans addressing the expansion of distinct priority sectors specified by China’s medium- and long-term development plans.

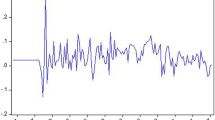

The data are collected from China Financial Statistics (2007), which offers a compilation of Chinese banking statistics not previously publicly released. The data frequency is monthly, and the data cover the period from 1997M1 to 2005M12. Although these unique data allow us to perform a fine-grained analysis, the time period is relatively short. We therefore test whether our benchmark results also hold for a longer time period. For this robustness exercise, we compile additional total loan statistics from the annual Almanac of China’s Finance and Banking. These almanacs contain total loans to non-financial institutions, albeit only at a quarterly level. Combined with total loans from the China Financial Statistics, this information provides us with a longer time series for total loans that stretches from 1997Q1 to 2008Q4. The almanacs, however, do not distinguish between short- and long-term loans and, consequently, lead to a less detailed analysis of the longer sample.Footnote 8 Figure 1 illustrates the total lending volumes for each bank type.

Real economic activity is modeled using six different estimates of the real economy: GDP, agricultural production, manufacturing production, service production, total factor productivity, and capital stock (see Online Appendix C for details). GDP is the most commonly used measure of real economic performance in the finance–growth literature. Because individual bank lending is unevenly distributed across economic sectors, it is not to be expected that potential growth effects would necessarily show in overall GDP growth. We therefore also separately test for growth effects for agriculture, manufacturing, and services. Moreover, considering the differences between typical borrowers, loan size and maturity bank loans are likely to affect growth through different transmission channels (Bonfiglioli 2008). For example, the dominance of infrastructure investments in PBs’ lending is likely to affect capital accumulation and productivity. JSCBs and RCCs, in contrast, typically prioritize short-term lending (see Table 2), which is less likely to affect the rate of capital growth but may nonetheless increase productivity. By relaxing firms’ short-term budget restrictions, such short-term loans may allow for internal restructuring, the introduction of new quality control systems, and human capital improvements. As an extension of the standard analysis, we therefore also include capital growth and total factor productivity (TFP) in our analysis.

Differentiating between the effect of bank lending on capital growth and the effect on TFP growth is not trivial. Loans for productive purposes can be used to either expand the capital stock or replace old capital with new and more productive capital. By including capital and TFP separately in our tests, we can explore not just the growth effects of the bank loans but also their potential use. Several cross-country studies have shown that income differences among countries are to a large extent explained by differences in TFP. Increasing the rate of TFP growth is thus crucial for developing countries to permanently close the income gap with developed countries. However, sustained TFP growth is generally more difficult to achieve than capital accumulation (Easterly and Levine 2002). Exploring the causal relationship between bank lending and capital as well as between bank lending and TFP growth offers important insights into the role financial markets play in the catching up process.

All real economic variables, except TFP, are collected from Thompson Financial Statistics Datastream. Because GDP data are only compiled on a quarterly basis, we construct matching quarterly observations of the lending data by using the last month of the respective quarter. Bank loans are deflated using the GDP deflator. GDP, agricultural production, manufacturing production, and service production are deflated using their respective deflators. All variables have been seasonally adjusted.Footnote 9 Total factor productivity growth is estimated as the Solow residual from a Cobb–Douglas production function with constant returns to scale,

where P is the logarithm of TFP, G is the logarithm of real GDP, C is the logarithm of the real capital stock, and E is the logarithm of the employment level. We use the standard assumption that \(\alpha _1 =0.3\) (Bekaert et al. 2011). As a robustness check, we confirm that our results also hold if the capital intensity is assumed to be 0.4 or 0.5.

Both a CUSUM test and a Chow break point test reveal a structural break in the short-run but not the long-run parameter values for JSCBs and SOCBs after 2001Q4 for the 1997Q1 to 2005Q4 sample and a break after 2003Q3 for the 1997Q1 to 2008Q4 sample. These breaks coincide broadly with the relaxation of central control over commercial bank lending toward the end of Zhu Rongji’s leadership and increasing responsiveness toward local political interference under Hun Jintao’s and Wen Jiabao’s leadership.Footnote 10 To account for this break in our tests, we define a dummy variable that separates the two periods. This yields the regression

where d is the dummy variable that takes a value of one after the indicated break. In the Granger causality tests, we test jointly whether the parameters are equal to zero both before and after the break. We also analyze the effect of the break on the banks’ abilities to promote growth.

4 Results and discussion

4.1 The role of idiosyncratic lending over time

As the first step of our analysis, we explore the extent to which growth in lending over time reflects idiosyncratic behavior linked to individual financial institutions and the extent to which lending patterns reflect common monetary policy and business cycle effects. Table 4 summarizes our results. Two observations stand out. First, JSCBs realized the highest quarterly average lending growth (6.5 % per quarter) between 1997Q1 and 2005Q4, which is most likely connected with the younger organizational age of these lending institutions relative to the age of the SOCBs as well as the retrenchment period in SOCB lending that lasted until 2002.Footnote 11 For the other bank types, the average quarterly lending growth varies between 1.9 (SOCBs) and 2.4 % (RCCs). Both PBs and SOCBs exhibit slower growth in short-term loans compared to long-term loans, which reflects a growing use of both banks as facilitators for government-directed capital accumulation. The JSCBs and RCCs, in contrast, have increased short-term and long-term lending at comparable rates. The contraction of short-term lending by SOCBs over the period also indicates that banks constrained the occurrence of rolling over of short-term loans that often were granted without any concern for the creditworthiness of the borrower (Cousin 2011). This trend is consistent with the reduced political support for small, local SOEs (Cao et al. 1999). The observed pattern is broadly confirmed for the longer sample: Here, lending growth by JSCB reached, on average, 5.6 %, whereas lending growth otherwise remained between 1.9 (SOCBs) and 2.8 % (PBs).

Second, our analysis reveals a substantial variation in the respective roles of the common and idiosyncratic components in explaining lending growth in China. Lending by PBs is least affected by common shocks. Depending on loan type, the common factor only explains between 3 and 18 % of the variability in lending growth between 1997 and 2005. This result is in line with the distinctive role policy banks, particularly the China Development Bank, play as facilitators of large-scale, politically driven infrastructure projects. For commercial banks, the explanatory power of the common factor is naturally higher and ranges between 40 and 60 % for total lending. For JSCBs, the common factor achieves the highest explanatory power, confirming the aforementioned stronger market orientation (and insulation from ad hoc policy interventions) of these banks. Over time, the common factor explains a larger proportion of the variation in comparison with what the shorter sample (1997–2005) shows. However, also in the longer sample, the difference in the degree of market orientation between JSCBs on the one hand and SOCBs and RCCs on the other persists.

The common factor explains more of the variation in total loans than for short- and long-term loans irrespective of bank type. Over time, there has been a re-allocation of the lending portfolios and a shift from short-term to long-term lending. Part of the variation in short-term and long-term loans is thus due to this re-allocation and not due to common shocks such as business cycle fluctuations. The relative share of the variation explained by the common factor is thus higher for total loans than for short-term and long-term loans.

4.2 Short-term growth effects between 1997 and 2005

Our analysis of short-term growth effects confirms substantial differences across bank types and loan maturities (see Table 5). For PBs, total lending Granger-causes both GDP and TFP growth. These effects are primarily driven by long-term loans that causally explain GDP growth and TFP growth, whereas short-term loans only have a temporary effect on manufacturing. For the service sector, long-term loans have a bidirectional Granger causal relationship with GDP. For agricultural, manufacturing, and capital growth, total policy bank lending follows rather than precedes short-term growth, reflecting the banks’ role as a political tool employed to respond to rather than drive market development. This finding is most pronounced in the case of agricultural production, which Granger-causes PB lending in the form of both short-term and long-term loans. This behavior is closely linked with the lending policies of the Agricultural Development Bank of China, which finances purchases of surplus grain and edible oil production from farmers to stabilize market prices.

Lending by SOCBs, China’s major commercial lender, in contrast, does not generate any positive short-term effects on growth with respect to total lending. Total lending activities also do not follow economic activity, leaving the lending performance virtually disconnected from activities in the real economy. For short-term lending, our tests suggest that SOCB loans reduce growth in GDP, manufacturing, and TFP below the levels they would otherwise have achieved. Still, the effect is relatively small, and overall growth remains positive despite this negative effect. This result is in line with the use of SOCBs as primary lenders to ailing SOEs undergoing reforms, while crowding out loans to more productive, often non-state enterprises not supported by central and local government directives. Incidents of repeated political interference in an effort to rescue prioritized large-scale state-owned enterprises have been widely reported (Wei and Wang 1997; Cull and Xu 2003; Shih et al. 2007). Our results, however, indicate that these government-designed rescue packages, often in the form of debt–equity swaps and interest-subsidized loans for technological improvements, have failed to produce positive growth effects. The only positive effect of SOCB loans in the short run is in the relationship between long-term loans and agricultural production. Because the structural break tests indicate a break in the parameters after 2001, we also compare the parameter estimates of the period before (1997–2001) and after the break (2002–2005). The identified short-term effects of SOCB lending, however, are confirmed, and the negative effects of SOCB loans increased slightly rather than decreased in the second period compared to the effects observed for the first period, despite action against non-performing loans.Footnote 12

Based on our estimations, JSCBs are the most effective among China’s commercial lenders in terms of short-term growth promotion. Although the market share of JSCBs had only reached 20 % of total loans by the end of 2005, the JSCB lending Granger-caused growth in GDP and manufacturing production by strengthening both TFP growth and capital growth. Similar to the result observed for SOCBs, the structural break test indicates a break in the short-run parameters after 2001Q4. An analysis of the respective subperiods shows that the positive growth effects generated by JSCB lending increased in the latter period. In light of the rapid expansion in JSCB lending (with an average growth rate of 6.5 %), it is reasonable to assume that growth effects increase as the banks’ market share gradually expands. The positive growth effects of total lending are not matched by similar effects stemming either from short-term or long-term loans. A possible explanation is that the lending portfolios of JSCBs have changed substantially over the observation period, with a redistribution of loans toward short-term lending. Once we include an interaction term between short-term and long-term lending in the Granger causality regressions, we find positive effects on growth.

RCC lending generates positive growth effects in the agricultural sector. As a downside, however, RCC lending also negatively Granger-causes manufacturing production and TFP growth. RCCs lend to local small-scale ventures and agricultural enterprises, and these loans are efficient in the sense that they expand overall agricultural production. However, these small ventures often operate below-average total factor productivity, and an expansion of these local ventures reduces overall productivity in the economy.

Lastly, a shock to the common factor has a positive effect on both GDP growth and agricultural production in the short run. However, the common factor has no short-term effects on manufacturing or services. This pattern is consistent with casual accounts reporting that expansive policy measures, such as low-interest-rate policies, introduced in an ad hoc manner may not benefit the best lenders but instead politically connected ones. During the global economic crisis, for instance, state-owned companies reportedly used stimulus money for stock market investments rather than productive uses. It is also notable that the common factor is Granger-caused by capital growth corresponding to China’s strong commitment to following a capital-driven growth strategy (Andersson et al. 2013).

4.3 Long-run growth effects between 1997 and 2005

Shifting our attention to the linkage between idiosyncratic lending behavior and long-run growth effects, the general account is comparable, revealing no major differences in the banks’ abilities to influence short-run or long-run growth objectives (see Table 6).

PB lending registers a bidirectional Granger causal effect between lending and TFP growth. Typically, there is a three- to four-quarter lag between short-run PB loans and TFP growth. This difference in lags is in line with the typical lending pattern of PBs, which provide financing for major capital investments such as infrastructure construction. Although these projects do not have immediate productivity effects, they can generate productivity effects for a large part of the local and regional economy once projects develop and reach completion. These positive growth effects of PBs are thus indirect rather than direct. Otherwise, PB lending follows rather than precedes growth in GDP, agriculture, and manufacturing. This result holds for both short- and long-term loans.

For SOCBs, the main lenders in China’s market for commercial loans, the long-run account seems particularly bleak. Not only do our estimates fail to reveal positive growth effects (and present a negative causal relationship between short-term lending and manufacturing growth), but SOCB lending between 1997 and 2005 also does not follow trends in domestic demand. In fact, SOCB lending appears virtually disconnected from economic realities over this period. Clearly, SOCBs fail to play the role of a strategic lender.

Although JSCB lending loses its positive impact on GDP growth observed in the short-run analysis, total JSCB lending still spurs long-term manufacturing growth and total factor productivity growth, which reinforces the superior lending decisions made by JSCBs relative to those made by SOCBs. This further undermines the developmental view of state banking, asserting that state ownership and political involvement may be better adapted to spur long-term economic development. Lastly, the long-term perspective confirms the difficult position of RCCs, which exert a positive effect on agricultural production but at the expense of manufacturing and TFP growth. These effects are closely associated with the local role of RCCs, limiting their economic activities to relatively confined lending markets, making efficient capital allocation rather difficult.

In the long run, the common factor is the only lending component that Granger-causes GDP growth and capital accumulation. Thus, despite China’s highly interventionist approach to financial institutions and domestic lending, by 2005, the only effective means to spur long-term GDP growth are monetary policies and market responses.

In sum, none of the financial institutions had positive effects on GDP growth in the long run. Regarding total lending, policy banks were able to promote total factor productivity growth, JSCB lending had a positive impact on manufacturing and total factor productivity development, and RCCs were able to promote agricultural production, albeit at the cost of slower growth in GDP, manufacturing, and TFP. The largest share of commercial lending conducted by SOCBs remained disconnected from the real economy, and neither spurred nor followed economic growth.

4.4 Robustness checks

To scrutinize our findings, we have extended our sample period to the end of 2008, which allows the inclusion of additional years covering a major reform package, the incorporation and stock listing of China’s SOCBs (see Table 7). This reform was initiated to bring in new minority investors and foreign expertise in an effort to help SOCBs modernize their bank operations and increase profitability. Moreover, the central government sought to reduce arbitrary political intervention at the local level, without losing majority control over financial assets. As a consequence of this partial depoliticization process, the balance sheets of SOCBs improved, as the successful reduction in non-performing loans to 1 % in 2010 confirms (China Banking Regulatory Commission 2010). Regrettably, data availability does not allow for an even longer sample.

As expected, the most critical changes are observed for SOCB lending. The completed incorporation and stock listing of SOCBs and concomitant hardening of budget constraints are associated with a closer alignment of bank activities with changes in the real economy. The main difference from the smaller sample is that SOCB lending is Granger-caused by developments in the real economy as measured by GDP, manufacturing production, service production, and TFP. Although SOCBs do not Granger-cause growth, they have begun to respond to economic growth. However, SOCB loans still Granger-cause negative growth effects in the manufacturing sector in the long run. This finding may hint at difficulties in breaking up established patronage and clientelist networks linking the management of state-owned companies, local politicians, and local branches of SOCBs. Clearly, the misallocation of loans in the manufacturing sector could not be stopped by the simple introduction of non-state minority shareholders. Structural break tests reveal a break in 2003Q2, 6 months later than the break in the shorter sample, and into the first year of a more decentralized approach to bank lending. The comparison of parameter estimates for both subsamples (1997Q2–2003Q2 and 2003Q3–2008Q4) shows that growth in the real economy Granger-causes SOCB lending in the second period but not in the first.Footnote 13 Apparently, the corporatization, governance, and management reforms applied to SOCBs have successfully led to a closer alignment of lending activities with changes in the real economy. However, to date, SOCB lending does not facilitate or promote economic growth.

For the other organizational forms, our results are largely confirmed. For PBs, the most notable difference from the previous sample is that PB lending Granger-causes not only short-run but also long-run GDP growth. JSCBs have expanded their positive impact on the real economy relative to the impact observed for the shorter sample. Similar to the previous results, JSCB loans positively Granger-cause GDP, manufacturing production, TFP, and capital accumulation in the short run. Unlike the shorter sample, these effects are also sustained in the long run in the case of manufacturing production and TFP growth. As in the case of SOCBs, the structural break tests reveal a significant break at approximately 2003Q2 for the short-run model. A comparison of the two periods’ parameter estimates reveals a slightly more significant effect in the second subperiod than in the first.Footnote 14 For RCCs, there are no significant structural breaks. The results for the expanded sample confirm those of the smaller sample: RCC lending promotes agricultural growth but has negative effects on the overall economy, possibly through its indirect effects on productivity and resource competition between agricultural and manufacturing firms.

Lastly, the short-run effects of the common factor are consistent with the observations made for our shorter sample. In the long run, however, the common factor now follows rather than promotes growth. Given the high-performance years preceding the 2008 global economic crisis, the monetary policy response was—as our results show— an effort to avoid an overheating of the economy rather than a tool employed to jump-start domestic growth processes.

5 Conclusions

The question of whether state-owned banks have a positive role to play in growth promotion and development has fascinated development economists over decades. This study provides new evidence by employing disaggregated lending data to produce a nuanced account of the nature of the finance–growth nexus in China. Using detailed lending data available for the period 1997–2008, Granger causality tests provide empirical insights into the short- and long-run relationship between bank lending and economic growth.

Our analysis shows that bank performance is closely linked to the nature of financial activities in which they are engaged. Between 1997 and 2008, only two types of banks generated positive effects on GDP growth: PB lending spurred GDP growth in the short and long run. Among the commercial lenders, only JSCB lending registered a positive impact on GDP growth. The main commercial lenders, the heavily state-controlled SOCBs prioritizing lending to China’s state-controlled corporate sector, did not contribute to growth. In the long run, SOCB lending slowed manufacturing growth. Clearly, this behavior suggests a crowding-out of credit to China’s highly productive small- and medium-sized private and politically unconnected firms (Shen et al. 2009; Nee and Opper 2012), which reveals standard problems commonly observed for state-owned commercial banks following political rather than economic principles (La Porta et al. 2002; Sapienza 2004).

Our results suggest several tentative conclusions. We assert that ownership alone is a poor predictor of the economic role state banks can play in fostering economic development. Although PBs and SOCBs were both wholly state-owned banks (until 2005), the difference in the identified finance–growth nexus is striking. Our analysis shows that government-directed policy lending may play a crucial role in infrastructure building and the provision of public goods. Involvement in commercial lending should be avoided, however, as SOCBs lending remained largely disconnected from economic realities and eventually limited economic growth. While our analytical design does not allow for causal inferences, the apparent misallocation of financial resources is most likely associated with the widely reported ad hoc political interference from various stakeholders in support of ailing state-owned companies. This interpretation is also consistent with the superior performance of JSCBs in which the state only holds a minority of shares.

Although China’s unique political system does not invite generalizations, our analysis calls for a more nuanced assessment of state banking that considers the distinct institutional and functional features of specific policy and commercial banks. Instead of focusing on simple comparisons between state-owned and private banks, it may be a worthwhile undertaking to generate more evidence on the growth contribution associated with different organizational and functional types of state-owned banks. This not only involves a focus on different lending portfolios associated with distinct banks but also requires closer analysis of the institutional embeddedness of state-owned banks and the potential insulation of banks against ad hoc interference from either central or local government representatives. Further research applying a disaggregated approach to lending analysis may provide much needed insights, particularly for developing countries, concerning how to employ state and policy banks to pursue real economic development goals successfully.

Notes

In the case of interest rate ceilings, the elite can, for instance, appropriate subsidized credit funds, whereas the poor are pushed into informal markets offering less-attractive lending terms (Burgess and Pande 2005).

These are the Agricultural Development Bank (ADB); the China Development Bank (CDB), which is primarily responsible for infrastructure projects; and the Export–Import Bank of China (Exim). Each of these banks specializes in developmental goals in line with the state’s medium- and long-term economic planning and is organized around distinct economic activities.

At the end of 2011, the state held 57.13 % of the total shares of CCB, 67.60 % of the shares of BOC, 82.7 % of the shares of ABC, and 70.7 % of the shares of ICBC (see Annual Bank Reports).

Examples include the 1998 bankruptcy of the Hainan Development Bank (HDB) and the 2004 takeover of the Shenzhen Development Bank by Newbridge Capital, a US investment firm (Podpiera 2006).

One way of dealing with the potential simultaneity problem would be to identify an exogenous shock in bank lending that affects only a certain group of banks and exploit such an exogenous shock to implement a difference-in-differences method. Unfortunately, all banking institutions in China considered within the investigation period have responded similarly to changing economic circumstances (as the large share of common component indicates), and this approach is thus infeasible.

As a robustness check, we also consider Akaike information criteria, but the choice of information criterion does not affect our overall conclusions.

The bank loan statistics contain two breaks: one in 2001Q1 for JSCBs and one in 2007Q1 for RCCs. The break for JSCBs is caused by an additional bank being added to the group of JSCB banks. The RCC break coincides with the intervention of the Central Bank, which removed a substantial amount of non-performing loans from the RCCs’ balance sheets. In parallel, ownership reforms reduced the RCC sector from 19,348 legal entities at the end of 2006 to fewer than 8509 by the end of 2007. To control for these breaks, we include dummy variables in our test regressions.

We use the Census X12 filter in EViews 7.1 to seasonally adjust the variables, which is the technique used by the US Census Bureau.

The 2001 break also corresponds to China’s WTO accession, allowing us to take into account its possible impact on bank lending.

These growth rates have been corrected for breaks in the time series in 2001Q1 (JSCBs) and 2007Q1 (RCCs).

Results are available upon request.

Results are available upon request.

Results are available upon request.

References

Andersson FNG, Edgerton D, Opper S (2013) A matter of time: revisiting growth convergence in China. World Dev 45:239–251

Andersson J (2005) Testing for Granger causality in the presence of measurement error. Econ Bull 3(47):1–13

Andrianova S, Demetriades P, Shortland A (2008) Government ownership of banks, institutions, and financial development. J Dev Econ 85:218–252

Ariff M, Can L (2008) Cost and profit efficiency of Chinese banks: a non-parametric analysis. China Econ Rev 19:260–273

Aziz J, Duenwald CK (2002) Growth-financial intermediation nexus in China. IMF Working Paper No. 02/194. International Monetary Fund, Washington

Bai J, Ng S (2004) A PANIC Attack on unit roots and cointegration. Econometrica 72:1127–1177

Banerjee AV (2003) Contracting constraints, credit markets and economic development. In: Dewatripont M, Hansen LP, Turnovsky SJ (eds) Adv Econ Econom. Cambridge University Press, Cambridge, pp 1–46

Barth JR, Caprio G, Levine R (2004) Bank regulation and supervision: what works best? J Financ Intermed 13:205–248

Bekaert G, Harvey CR, Lundblad C (2011) Financial openness and productivity. World Dev 39:1–19

Berger AN, Hasan I, Zhou M (2009) Bank ownership and efficiency in China: what will happen in the world’s largest nation? J Bank Financ 33:113–130

Bonfiglioli A (2008) Financial integration, productivity and capital accumulation. J Int Econ 76:337–355

Boyreau-Debray G (2003) Financial intermediation and growth: Chinese style. Policy research working paper series 3027. Washington: The World Bank

Burgess R, Pande R (2005) Do rural banks matter? Evidence from the Indian social banking experiment. Am Econ Rev 95:780–795

Cao Y, Qian Y, Weingast BR (1999) From federalism, Chinese style to privatization, Chinese style. Econ Transit 7:103–131

Chang TP, Hu JL, Chou RY, Sun L (2012) The sources of bank productivity growth in China during 2002–2009: a disaggregation view. J Bank Financ 36:1997–2006

Cheng X, Degryse H (2010) The impact of bank and non-bank financial institutions on local economic growth in China. J Financ Serv Res 37:179–199

China Banking Regulatory Commission (2009) Annual Report 2009. China Finance Publishing House, Beijing

China Finance Society. Almanac of China’s Finance and Banking, Issues 2006–2009. China Finance Publishing House, Beijing

Cousin V (2011) Banking in China, 2nd edn. Palgrave Macmillan, New York

Cull R, Xu LC (2003) Who gets credit? the behavior of bureaucrats and state banks in allocating credit to Chinese state-owned enterprises. J Dev Econ 71:533–559

Dave C, Dressler SJ, Zhang L (2013) The bank lending channel: a FAVAR analysis. J Money Credit Bank 45:1705–1720

Demetriades PO, Hussein KA (1996) Does financial development cause economic growth? Time-series evidence from 16 countries. J Dev Econ 51:387–411

Demirgüc-Kunt A, Detragiache E (1998) The determinants of banking crises in developing and developed countries. IMF Staff Pap 45:81–109

Dewenter K, Malatesta PH (2001) State-owned and privately owned firms: an empirical analysis of profitability, leverage, and labor intensity. Am Econ Rev 91:320–334

Easterly W, Levine R (2002) It’s not factor accumulation: stylized facts and growth models. In: Loayza N, Soto R, Loayza N, Schmidt-Hebbel K (eds) Economic growth, sources, trends, and cycles. Central Bank of Chile, Santiago, pp 61–114

Financial Survey and Statistics Department of the Peoples Bank of China (2007) China Financial Statistics: 1949–2005. China Financial Publishing House, Beijing

Gao W (2012) Financial development in rural China: with special reference to the reform of the Chinese rural credit cooperative. Economic Science Press, Beijing

Garcia-Herrero A, Gavila S, Santabarbara D (2006) China’s banking reform: an assessment of its evolution and possible impact. CESifo Econ Stud 52:304–363

García-Herrero A, Gavila S, Santabarbara D (2009) What explains the low profitability of Chinese banks? J Bank Financ 33:2080–2092

Granger C (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37:424–438

Gries T, Kraft M, Meierrieks D (2009) Linkages between financial deepening, trade openness, and economic development: causality evidence from Sub-Saharan Africa. World Dev 37:1849–1860

Gündüz Y, Kaya O (2014) Impacts of the financial crisis on eurozone sovereign CDS spreads. J Int Money Financ 49(Part B):425–442

Hao C (2006) Development of financial intermediation and economic growth: the Chinese experience. China Econ Rev 17:347–362

Hasan I, Wachtel P, Zhou M (2009) Institutional development, financial deepening and economic growth: evidence from China. J Bank Financ 33:157–170

Hausmann R, Rodrik D (2003) Economic development as self-discovery. J Dev Econ 72:603–633

Heremans D, Pacces AM (2012) Regulation of banking and financial markets. In: Van den Bergh RJ, Pacces AM (eds) Encyclopedia of law and economics: regulation and economics. Edward Elgar, Cheltenham, pp 558–606

Hu Y, Opper S, Wong SML (2006) Political economy of labor retrenchment: evidence based on China’s SOEs. China Econ Rev 17:281–299

Kamin SB, Rogers JH (2000) Output and the real exchange rate in developing countries: an application to Mexico. J Dev Econ 61:85–109

La Porta R, Lopez-de-Silanes F, Shleifer A (2002) Government ownership of banks. J Financ 57:265–301

Liang Q, Teng J (2006) Financial development and economic growth: evidence from China. China Econ Rev 17:395–411

Lin X, Zhang Y (2009) Bank ownership reform and bank performance in China. J Bank Financ 33:20–29

Matthews K, Zhang NX (2010) Bank productivity in China 1997–2007: measurement and convergence. China Econ Rev 21:617–628

Micco A, Panizza U (2006) Bank ownership and lending behavior. Econ Lett 93:248–254

Morck R, Deniz Yavuz M, Yeung B (2011) Banking system control, capital allocation, and economy performance. J Financ Econ 100:264–283

Naka A, Tufte D (1997) Examining impulse response functions in cointegrated systems. Appl Econ 29:1593–1603

Nee V, Opper S (2010) Political capital in a market economy. Soc Forces 88:2105–2133

Nee V, Opper S (2012) Capitalism from below: markets and institutional change in China. Harvard University Press, Cambridge

OECD (2004) China in the global economy: rural finance and credit infrastructure in China. OECD Publishing, Paris

Podpiera R (2006) Progress in China’s banking sector reform: has bank behavior changed? IMF working paper No. 06/71. International Monetary Fund, Washington

Qian J, Strahan P, Yang Z (2011) The impact of incentives and communication costs on information production: evidence from bank lending. Presented at the annual Financial Intermediation Research Society Conference in Sydney

Rousseau PL, D’Onofrio A (2013) Monetization, financial development, and growth: time series evidence from 22 countries in Sub-Saharan Africa. World Dev 51:132–153

Rousseau PL, Vuthipadadorn D (2005) Finance, investment, and growth: time series evidence from 10 Asian economies. J Macroecon 27:87–106

Rousseau PL, Wachtel P (1998) Financial intermediation and economic performance: historical evidence from five industrialized countries. J Money Credit Bank 30:657–678

Rousseau PL, Xiao S (2007) Banks, stock markets and China’s great leap forward. Emerg Mark Rev 8:206–217

Sanderson H, Forsythe M (2013) China’s superbank: debt, oil and influence-how China development bank is rewriting the rules of finance. Bloomberg Press, Singapore

Sapienza P (2004) The effects of government ownership on bank lending. J Financ Econ 72:357–384

Shen CH, Lin CY (2012) Why government banks underperform: a political interference view. J Financ Intermed 21:181–202

Shen Y, Shen M, Xu Z, Bai Y (2009) Bank size and small- and medium-size enterprise lending: evidence from China. World Dev 37:800–811

Shih V, Zhang Q, Liu M (2007) Comparing the performance of Chinese banks: a principal component approach. China Econ Rev 18:15–34

Shleifer A (1998) State versus private ownership. J Econ Perspect 12:133–150

Shleifer A, Vishny R (1998) The grabbing hand: government pathologies and their cures. Harvard University Press, Cambridge

Sims CA (1972) Money, income, and causality. Am Econ Rev 62:540–552

Stiglitz JE (1994) The role of the state in financial markets. In: Bruno M, Pleskovic B (eds) Proceedings of the world bank annual conference on development economics. The World Bank, Washington, pp 19–52

Toda HY, Yamamoto T (1995) Statistical inferences in vector autoregressions with possibly integrated processes. J Econom 66:225–250

Wei S, Wang T (1997) The siamese twins: do state-owned banks favor state-owned enterprises in China? China Econ Rev 8:19–29

Yeyati EL, Micco A, Panizza U, Detragiache E, Repetto A (2007) A reappraisal of state-owned banks. Economía 7:209–259

Yilmazkuday H (2011) Thresholds in the finance-growth nexus: a cross-country analysis. World Bank Econ Rev 25:278–295

Acknowledgments

The authors would like to thank the editor and the anonymous referee for their helpful comments and suggestions. Sonja Opper acknowledges financial support from the Jan Wallanders and Tom Hedelius Foundation, Fredrik NG Andersson gratefully acknowledges funding from the Swedish Research Council.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Andersson, F.N.G., Burzynska, K. & Opper, S. Lending for growth? A Granger causality analysis of China’s finance–growth nexus. Empir Econ 51, 897–920 (2016). https://doi.org/10.1007/s00181-015-1034-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-015-1034-8