Abstract

Bank customers are not financial experts, and yet they make high-stakes decisions that can substantively affect personal wealth. Sooner or later, every individual has to take relevant investment decisions. Using data collected from financial advisors, bank customers and university students in Italy, this paper aims to reveal new insights about the decision processes of average non-expert investors: their investment goals, the information sets they consider, and the factors that ultimately influence decisions about investment products. Using four portfolio choice tasks based on data collected directly from financial advisors and their clients, we find that most subjects used a limited set of information, ignoring factors that conventional economic models usually assume drive investor behavior. Furthermore, we suggest that non-compensatory decision-tree models, which make no trade-offs among investment features, are parsimonious descriptions of investor behavior useful for improving the organization of financial institutions and in policy contexts alike.

Similar content being viewed by others

Notes

Linear models of investor behavior, such as those derived from expected utility maximization with a mean–variance expected utility function, assume that all features of each investment alternative are weighted and summed (and possibly transformed by a monotonic function). In contrast, non-compensatory models have a fixed hierarchy of investment features. One investment feature (e.g., high risk) can be enough to entirely discard an alternative from the investor’s consideration set, without the possibility of compensation (e.g., standard models typically assume that, no matter how high the risk, this negative can be compensated with sufficiently large positives such as high expected return). Just as Yee et al. (2007) found that consumers can effectively manage large choice sets by quickly shrinking the items in consideration using a single product feature, we consider models which allow data to reveal this kind of fast reduction of choice sets by lexicographically ruling out alternatives based on one undesirable feature.

These terms are translations of the Italian terms used by the banks’ financial advisors. Their imprecision would likely make any student of financial economics blush or, better still, demand more specificity. What, for example, does “risk” mean? Nevertheless, our goal was to calibrate all experimental details to the actual investment environment faced by the consumers who served as subjects. Thus, the terms are regrettably vague: rischio, durata, costo, liquidabilità, spese di uscita and interessi.

The maximum number of six investment features that can be looked up actually comes from information collected from investment advisors. They told us that, due to time constraints and limitations of customers’ understanding of and capacity to absorb investment information, they commonly consider the upper limit to be six pieces of information.

By recognition heuristic, we mean a simple strategy that allows individuals to infer, for example, which of two objects has a higher value on some numerical criterion, based on the fact that one is recognized and the other is not (e.g., predicting which investment has a higher expected return based on whether one recognizes the name of one of the shares). The recognition heuristic for such tasks is simply stated: If one of the two objects is recognized and the other is not, then infer that the recognized object has the higher value (Goldstein and Gigerenzer 2002).

References

Balzer WK, Doherty ME, O’Connor R (1989) Effects of cognitive feedback on performance. Psychol Bull 106(3):410–433

Berg N, Hoffrage U (2008) Rational ignoring with unbounded cognitive capacity. J Econ Psychol 29(6):792–809

Chewning E, Harrell A (1990) The effect of information overload on decision makers’ cue utilization levels and decision quality in financial distress decision task. Acc Org Soc 15(6):527–542

DeMiguel V, Garlappi L, Uppal R (2009) Optimal versus naive diversification: how inefficient is the 1/N portfolio strategy. Rev Financ Stud 22:1915–1953

Fischbacher U (2007) z-Tree: zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Gigerenzer G (2008) Why heuristics work. Perspect Psychol Sci 3:20–29

Gigerenzer G, Brighton H (2009) Homo heuristicus: why biased minds make better inferences. Topics Cogn Sci 1:107–143

Gigerenzer G, Goldstein DG (1996) Reasoning the fast and frugal way: models of bounded rationality. Psychol Rev 103(4):650–669

Gigerenzer G, Todd PM, the ABC Group (1999) Simple heuristics that make us smart. Oxford University Press, New York

Goldstein DG, Gigerenzer G (2002) Models of ecological rationality: the recognition heuristic. Psychol Rev 109:75–90

Lee BK, Lee WN (2004) The effect of information overload on consumer choice quality in an on-line environment. Psychol Market 21:159–183

Loewenstein G (2006) The pleasures and pains of information. Science 312:704–706

Lynch JG Jr, Ariely D (2000) Wine online: search costs and competition on price, quality, and distribution. Market Sci 19:83–103

Magni CA (2009) Investment decisions, net present value and bounded rationality. Quant Financ 9(8):967–979

Martignon L, Katsikopoulos KV, Woike JK (2008) Categorization with limited resources: a family of simple heuristics. J Math Psychol 52:352–361

Martignon L, Laskey K (1999) Bayesian benchmarks for fast and frugal heuristics. In: Gigerenzer G, Todd PM, the ABC Group (eds) Simple heuristics that make us smart. Oxford University Press, New York

Payne J, Bettman R, Johnson EG (2004) Fast and frugal heuristics: the tools of bounded rationality. In: Koehler D, Harvey N (eds) Handbook of judgment and decision-making. Blackwell, Oxford, pp 62–89

Train KE (2003) Discrete choice methods with simulation. Cambridge University Press, Cambridge

Yee M, Dahan E, Hauser JR, Orlin JB (2007) Greedoid-based non-compensatory two-stage consideration-then-choice inference. Market Sci 26:532–549

Acknowledgments

We thank John Payne for very helpful comments and Michela Balconi for her ideas regarding data analysis. We also thank Davide Donati, general director of the Cassa Rurale Giudicarie Valsabbia Paganella, and all the Board of Executives, for their full support in conducting on-site research at their banks. We likewise thank Marcel Jentsch for valuable help programming and designing interactive interfaces. Riccardo Boero acknowledges financial support from Regione Piemonte [IIINBEMA Research Project].

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

The experimental design is driven by the principle of preserving the comparability with results obtained with bank customers creating a realistic investment environment.

It relies on the computation of payoffs for each choice made by subjects through the modeling of the outcome of each investment in a virtual financial market with realistic economic incentives and uncertainty.

Economic earnings are computed using experimental currency units (ECU) which are then converted in euro according to a fixed conversion rate that is explained above in the paper. In other words, in the following we talk about earnings in ECU but they correspond to actual money.

The payoff structure we develop is built as a unique payoff function which works for every investment because every single different feature of investments is represented by different parameters in the function. Below each element of the payoff function is singularly discussed, and finally some examples of the aggregated payoff function are presented.

1.1 The portfolio duration

Due to the aim of modeling the intrinsic uncertainty of investment decisions we rely on the happening of probabilistic events. In particular after each investment decision a time of duration of the portfolio (in Task 1 and 2 is the duration of the single investment that has been chosen because the investment portfolio collapses in the choice of a single investment) is randomly chosen, with a uniform probability distribution, among the five possible ones (i.e., immediate, short, medium and long, and very long that is to say, in numbers, 0, 1, 2, 3, and 4). The reason for considering the possibility of very short (i.e., “immediate”) duration of investment decisions is to make even short duration investments subjects to some uncertainty as it will be better detailed below. Thus, the portfolio duration is a discrete random variable as follows:

where PD t , the duration of the portfolio choice, is a random variable uniformly draw from the set of integers ranging from 0 to 4 (i.e., from very short to long).

The portfolio duration can be conceived as the time when the investor is asked to dismiss her portfolio due to an external shock (e.g., the need for liquidity for relocating, for medical care, etc.…). It is an uncertain and random event that every investor knows to potentially face and that in our design models the uncertain lasting of investment decisions made by subjects.

A portfolio duration is, during the experiment, randomly drawn for each investment choice made by each subject: that is to say that it is randomly chosen for each subject on every repetition of each single task of the experiment and, obviously, it is not known by subjects before the choice.

1.1.1 The payoff function

The payoff function consider all the six characteristics differentiating investment decisions and the values each feature can take. In this paragraph we consider each feature and transform it to an ECUs value. The payoff function will then be just the sum of the ECUs obtained by each feature.

The characteristics of investment decisions that subjects face in the different experiment tasks are six and each one has a different set of possible values, as follows (the possible values of each feature are presented between brackets):

-

1.

liquidity (easy, difficult);

-

2.

coupon (no, yes);

-

3.

cost before redemption (no, yes);

-

4.

risk (low, medium, high);

-

5.

time horizon (short, medium, long);

-

6.

cost (low, medium, high).

The same list, represented in formal means is as follows (where “i” stands for each investment):

-

1.

\( liq_{i} \in \left\{ {0,1} \right\}; \)

-

2.

\( cou_{i} \in \left\{ {0,1} \right\}; \)

-

3.

\( cbr_{i} \in \left\{ {0,1} \right\}; \)

-

4.

\( risk_{i} \in \left\{ {0,1,2} \right\}; \)

-

5.

\( tih_{i} \in \left\{ {0,1,2} \right\}; \)

-

6.

\( cost_{i} \in \left\{ {0,1,2} \right\}. \)

1.1.1.1 Liquidity

The lack of liquidity of an investment can be a cost if the investor has to dismiss the investment before its natural end. Thus, such a cost emerges if and only if the chosen investment has “difficult” value of liquidity and the portfolio duration is shorter than the investment time horizon. In mathematical language liquidity contributes to the payoff with \( - urgency_{ti} \cdot liq_{i} \cdot k_{liquidity} \),

where \( urgency_{it} = \left\{ {\begin{array}{*{20}c} {\begin{array}{*{20}c} {0, \,when} & {tih_{i} < PD_{t} } \\ \end{array} } \\ {\begin{array}{*{20}c} {1, \,when} & {tih_{i} \ge PD_{t} } \\ \end{array} } \\ \end{array} } \right. \), and that is to say that the contribution of the liquidity feature is a cost (a negative impact of the parameter k liquidity ) that happens only if the liquidity is difficult and the duration of the portfolio (PD t ) is shorter than the time horizon of the investment (tih i ).

1.1.1.2 Coupon

The presence of coupons increases the return of an investment. Obviously it also depends on the time an investment is kept, and thus the amount of earnings deriving from coupons depends on the portfolio duration. In a formal way it is \( PD_{t} \cdot cou_{i} \cdot k_{coupon} \), meaning that coupons (if present) increase the return of an investment by a constant value (k coupon ) multiplied for the portfolio duration (PD t ).

1.1.1.3 Cost before redemption

The cost before redemption negatively modifies the return of an investment if and only if that feature characterizes the investment and if the portfolio duration is shorter than the investment time horizon (i.e., the urgency ti value computed as above equals 1): \( - urgency_{ti} \cdot cbr_{i} \cdot k_{{\textit{costBeforeRedemption}}} . \)

1.1.1.4 Risk

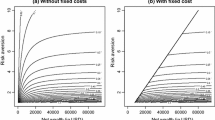

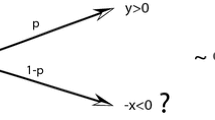

Risk is the main component of an investment return. If risk is higher, profits can be higher but also more uncertain. We combine different risk values (probabilities) and different returns promised by the investment. We thus extract a new, continuous and uniform, random variable “risk probability” \( RP_{ti} = \xi \in \left( {\frac{{3 = risk_{i} }}{3},1 + risk_{i} } \right] \) and multiply it for the parameter value k risk .

The mathematical expression of the positive return coming from investments is thus RP ti ·k risk which implies, according to risk i values, the following maximum, average and minimum yields (Table 8).

As the table points out, riskier investments on average yield higher profits, but there is also the chance of gaining much less profits.

1.1.1.5 Time horizon

The time horizon of the investment does not imply a cost per se but it affects other cost elements (i.e., liquidity and cost before redemption) impacting on the conditional variable called urgency ti .

1.1.1.6 Cost

The cost for buying an investment can vary and it represents a value decreasing the payoff of each investment. It is computed as \( - (cost_{i} + 1) \cdot k_{cost} \), that is to say that the cost increases proportionally to the value of cost i and to the parameter k cost .

1.1.1.7 The payoff function

Putting together the elements just introduced, the payoff function of an investment i at time t takes the following form:

where \( PD_{t} = \xi \in \left\{ {0,1,2,3,4} \right\} \), \( urgency_{it} = \left\{ {\begin{array}{*{20}c} {\begin{array}{*{20}c} {0, when} & {tih_{i} < PD_{t} } \\ \end{array} } \\ {\begin{array}{*{20}c} {1, when} & {tih_{i} \ge PD_{t} } \\ \end{array} } \\ \end{array} } \right. \), and \( RP_{ti} = \xi \in \left( {\frac{{3 = risk_{i} }}{3},1 + risk_{i} } \right] \).

1.1.1.8 Examples

Just as an example to make the payoff computation clearer, it is possible to specify parameters values and to report some investment profits.

Hypotheses

-

Parameters values: k risk = 100, k coupon = 10, k liquidity = 10, k costBeforeRedemption = 10, k cost = 5.

-

Payoff function:

$$ \pi_{it} = RP_{it} \cdot 100 + PD_{t} \cdot cou_{i} \cdot 10 - urgency_{ti} \cdot liq_{i} \cdot 10 - urgency_{ti} \cdot cbr_{i} \cdot 10 - \left( {cost_{t} + 1} \right) \cdot 5 $$

-

1.

Insurance with guaranteed capital:

-

Features: liquidity = difficult, coupon = no, cost before redemption = yes, risk = low, time horizon = medium, cost = high.

-

Randomly drawn variables: PD t = 1, urgency ti = 1 (in fact time horizon is medium and PD t is short), RP ti = 1.

-

The payoff: \( \pi_{it} = 1 \cdot 100 + 1 \cdot 0 \cdot 10 - 1 \cdot 1 \cdot 10 - 1 \cdot 1 \cdot 10 - \left( {2 + 1} \right) \cdot 5 = 65 \).The result is that an insurance investment, if dismissed before its natural end, generate lower earnings.

-

-

2.

Government Bonds:

-

Features: liquidity = easy, coupon = yes, cost before redemption = yes, risk = low, time horizon = medium, cost = low.

-

Randomly drawn variables: PD t = 3, urgency ti = 0 (in fact time horizon is medium and PD t is long), RP ti = 1.

-

The payoff: \( \pi_{it} = 1 \cdot 100 + 3 \cdot 1 \cdot 10 - 0 \cdot 0 \cdot 10 - 0 \cdot 1 \cdot 10 - \left( {0 + 1} \right) \cdot 5 = 125 \). The result is that the investment in government bonds is hre prolonged and coupon earnings are obtained for the duration of the investment.

-

1.1.1.9 Parameters values

During the experiment, the parameters used for calculating subjects’ profits are given in Table 9.

Appendix B

2.1 Overlapping Information Index

Give a set of information for investment 1, denoted A, and a set of information for investment 2, denoted B, which contain all the information explored by each subject for each investment choice, the OII measure of overlapping information (introduced in the body of this paper) is simply the cardinality of the intersection of these two sets for each participant:

2.2 Order Preservation Index

The Order Preserving Index takes not of the order in which the elements of the information sets A and B were generated by subjects’ search behavior. We write the elements of the set A as a vector that records this sequence: a = [a1, a2, …, an], where n denotes the number of items searched for or looked up by a particular subject. The index of subjects’ identities is suppressed here for expositional clarity in describing the information indexes used in the paper’s section on process tracing. Thus, ai was looked up before aj if and only if i < j. Similarly, a vectorized version of the set B that records the order in which information was looked up is denoted as b = [b1, b2, …, bn].

The (n + 1) × (m + 1) matrix referred to as the so-called F matrix (see Payne et al. 2004) plays a key role in process tracing. The first column and first row of the matrix F are initialized as 0. In MATLAB command language, this is expressed as F(1,1:m + 1) = 0 and F(1:n + 1,1) = 0.

The rest of the matrix is computed according to a recurrence relation, the Needleman-Wunsch algorithm. The order of the steps follow from the sequence given by vectors a and b.

where

Finally, the OPI is computed as:

The expression above is either normalized to a 0–100 percentage-point scale or interpreted as decimal representations of percentages that lie in the unit interval. An example that visually illustrates the recursion relation described above symbolically follows. This visual corresponds to the example discussed in. Sect. 3.4 (Fig. 6)

Rights and permissions

About this article

Cite this article

Monti, M., Boero, R., Berg, N. et al. How do common investors behave? Information search and portfolio choice among bank customers and university students. Mind Soc 11, 203–233 (2012). https://doi.org/10.1007/s11299-012-0109-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11299-012-0109-x