Abstract

The structural model uses the firm-value process and the default threshold to obtain the implied credit spread. Merton’s (J Finance 29:449–470, 1974) credit spread is reported too small compared to the observed market spread. Zhou (J Bank Finance 25:2015–2040, 2001) proposes a jump-diffusion firm-value process and obtains a credit spread that is closer to the observed market spread. Going in a different direction, the reduced-form model uses the observed market credit spread to obtain the probability of default and the mean recovery rate. We use a jump-diffusion firm-value process and the observed credit spread to obtain the implied jump distribution. Therefore, the discrepancy in credit spreads between the structural model and the reduced-form model can be removed. From the market credit spread, we obtain the implied probability of default and the mean recovery rate. When the solvency-ratio process in credit risk and the surplus process in ruin theory both follow jump-diffusion processes, we show a bridge between ruin theory and credit risk so that results developed in ruin theory can be used to develop analogous results in credit risk. Specifically, when the jump is Logexponentially distributed, it results in a Beta distributed recovery rate that is close to market experience. For bonds of multiple seniorities, we obtain closed-form solutions of the mean and variance of the recovery rate. We prove that the defective renewal equation still holds, even if the jumps are possibly negative. Therefore, we can use ruin theory as a methodology for assessing credit ratings.

Similar content being viewed by others

References

Artzner P, Delbaen F (1995) Default risk insurance and incomplete markets. Math Finance 5:187–195

Black F, Cox JC (1976) Valuing corporate securities: Some effects of bond indenture provisions. J Finance 31:351–367

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81:637–654

Carty LV, Lieberman D (1996) Corporate bond defaults and default rates 1938–1995. Moody’s Investors Service, Global Credit Research

Chen CJ, Panjer HH (2003) Unifying discrete structural models and reduced-form models in credit risk using a jump-diffusion process. Insur Math Econ 33:357–380

Duffie D (1998) Defaultable term structure models with fractional recovery of par, working paper. Graduate School of Business, Stanford University

Duffie D, Singleton KJ (1999) Modeling term structures of defaultable bonds. Rev Financ Stud 12:687–720

Dufresne F, Gerber H (1991) Risk theory for the compound Poisson process that is perturbed by diffusion. Insur Math Econ 10:51–59

Gerber H (1970) An extension of the renewal equation and its application in the collective theory of risk. Scand Actuarial J 205–210

Gerber H, Shiu ESW (1997) The joint distribution of the time or ruin, the surplus immediately before ruin, and the deficit at ruin. Insurance: Math Econ 21:129–137

Jarrow RA, Turnbull SM (1995) Pricing derivatives on financial securities subject to credit risk. J Finance 50:53–86

Jarrow RA, Lando D, Turnbull SM (1997) A Markov model for the term structure of credit risk spreads. Rev Financ Stud 10:481–523

Jones EP, Mason SP, Rosenfeld E (1984) Contingent claims analysis of corporate capital structures: an empirical investigation. J Finance 39:611–627

Kou SG, Wang H (2004) Option pricing under a double exponential jump diffusion model. Manag Sci 50:1178–1192

Leland HE (1994) Coporate debt value, bond covenants, and optimal capital structure. J Finance 49:1213–1252

Li D (1998) Constructing a credit curve. Credit risk: risk special report, November, pp 40–44

Longstaff FA, Schwartz ES (1995) A simple approach to valuing risky fixed and floating rate debt. J Finance 50:789–819

Madan DB, Unal H (1998) Pricing the risks of default. Rev Derivat Res 2:121–160

Merton RC (1974) On the pricing of corporate debt: The risk structure of interest rates. J Finance 29:449–470

Merton RC (1976) Option pricing when underlying stock returns are discontinuous. J Financial Econ 3:125–144

Moody’s Investors Service (January 1997) Historical default rates of corporate bond issuers, 1920–1996. Moody’s Investors Service. http://www.moodys.com

Moody’s Investors Service (January 1999) Historical default rates of corporate bonds issuers, 1920–1998. Moody’s Investors Service. http://www.moodys.com

Vasicek O (1977) An equilibrium characterisation of the term structure. J Financ Econ 5:177–188

Wang G, Wu R (2000) Some distribution for classical risk process that is perturbed by diffusion. Insur Math Econ 26:15–24

Yang H (2003) Ruin theory in a financial corporation model with credit risk. Insur Math Econ 33:135–145

Zhou C (2001) The term structure of credit spreads etf with jump risk. J Bank Finance 25:2015–2040

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix

The infinite time defective renewal

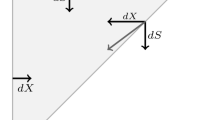

We now derive an extended defective renewal equation when the jumps are possibly negative. In this section, we assume the riskless rate r is constant. By the law of total probability, we have

This equation shows that the probability of survival is equivalent to the sum of the probability of survival given no jump in the small time interval (t, t + dt] and the probability of survival given a jump in the small time interval (t, t + dt] given that the jump is smaller than that will cause ruin. We have

We can express the expected value of survival probability through Taylor expansion as

where \(\phi^{\prime\prime}(u)\) stands for \(\frac{\partial^2\phi(u)}{\partial u^2}\).

If we substitute this into Eq. 24, ignore dt 2 and divide both sides of the equation by dt, we obtain

Since \(\phi\left(\ln\left({\frac{V_0}{D}}\right)\right)=1-\psi\left(\ln\left({ \frac{V_0}{D}}\right)\right)\), the integral-differential equation for \(\psi\left(\ln\left({ \frac{V_0}{D}}\right)\right)\) is given by

If we integrate both side of Eq. 25 over \(u=\ln\left({\frac{V_0}{D}}\right)\), we have

With the boundary condition ϕ(0) = 0, we have

where s is finite.

As \(s \rightarrow \infty\), we have

or \(\phi^{\prime}(0)=\frac{c-\lambda\mu_{X}}{\frac{\sigma^2}{2}}\). Since that \(\theta=\frac{c-\lambda\mu_{X}}{c}\) and \(\alpha=\frac{r-\frac{\sigma^2}{2}-\lambda\mu_J}{\sigma^2/2}\), the Eq. 26 can be rewritten as

This is a defective renewal equation when the jumps are possibly negative.

Rights and permissions

About this article

Cite this article

Chen, CJ., Panjer, H. A bridge from ruin theory to credit risk. Rev Quant Finan Acc 32, 373–403 (2009). https://doi.org/10.1007/s11156-008-0100-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-008-0100-0