Abstract

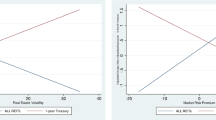

In this paper, we derive an equilibrium relationship between the yields on Eurodollar and Treasury bills based on equivalent martingale results derived by Harrison and Kreps (1979) and Harrison and Pliska (1981, 1983) as well as the corporate debt pricing model developed by Merton (1974). The derived equilibrium relationship incorporates the models used by Booth and Tse (1995) and Shrestha and Welch (2001) as special cases. The equilibrium relationship indicates that the conditional volatility of the yield on Eurodollars explains the variation in the TED spread. We empirically test the equilibrium relationship using a GARCH-M model and the concept of fractional cointegration. We use both the ex ante data implied by the respective futures contracts as well as the ex post spot data with daily, weekly and monthly frequencies. We find empirical support for the Equilibrium relationship.

Similar content being viewed by others

Notes

Readers interested in the integration of international financial markets are referred to Lothian (2002).

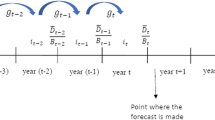

TED spread is generally defined as the difference between the interest rates implied by the Eurodollar and Treasury bill futures contracts of the same maturity. In this paper, we analyze both the TED spread implied by the futures contracts and the TED spread measured by the difference between the spot Eurodollar and the Treasury bill rates. Since the rate implied by the futures contract can be taken as the expected rate in the future, we will refer the first TED spread (implied by the futures contracts) as the expected or ex ante TED spread and the latter one (computed based on spot rates) as the actual or ex post TED spread.

The mean-reverting process means that the infinite cumulative impulse response is zero. This mean-reverting characteristic, when applied to the relationship between the two interest rates, implies that any deviation from equilibrium at time t will disappear in an infinite number of periods in the future.

For simplicity, we assume that the R fraction of the face value will be paid on maturity even if the default occurs before the maturity date T.

We deal with the issue of cointegration in detail in the next section.

For a detailed discussion of such models, see Duffie and Singleton (2003).

Actually, the short rate does not have to be non-stochastic. We will discuss this issue later (see footnote 10).

It can be shown that \(\frac{{\partial B_d \left( {t,T} \right)}}{{\partial \sigma }} = - Vn\left( { - h_2 } \right)\sqrt {T - t} < 0 \), where n( ) is the standard normal density function.

In the derivation of Eqs. (8) and (9), we assumed the default-free short rate to be non-stochastic. However, this assumption is not necessary. We can allow the short rate to be stochastic in which case e −r(T−t) should be replaced by default-free ZCB price B (t, T) and σ 2(T−t) should be replaced by generalized variance term (see Merton (2000), 395). Alternatively, we can assume that the value of the firm at time T is log-normally distributed with variance σ 2(T−t) in a forward risk neutral world.

See Baillie (1996) for a comprehensive discussion on the long memory process.

The property that the series X t with d ≥ 0.5 have infinite variance would play an important role in the definitions of mean-reverting and stationary fractional cointegrations to be discussed later.

This definition can be generalized by allowing d to be less than 1 but still non-stationary, i.e., 0.5 ≤ d ≤ 1.

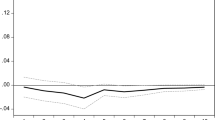

Here t represents the time trend. We are including the time trend to capture the observed declining trend in TED spread (please see Fig. 1).

In the variance equation (Eq. (19)) all the parameters are squared in order to avoid the variance being negative in the process of numerical optimization.

Before using the heteroscedastic model given above, the existence of a heteroscedasticity can be tested using the LM test (see Engle (1982)). If the heteroscedasticity is found to be absent, then the cointegrating regression reduces to Eq. (17) with trend term.

The LM statistic is computed by estimating the regression of the squared residual on its own 1 to 5 period lags.

Here we are dealing with non-nested models. For example, GARCH-M(3,1) and GARCH(1,3)-M are non-nested. Therefore, we cannot use likelihood ratio criteria to choose the best-suited model.

This is our conjecture at this time. We intend to follow this in the future.

For all the models, the estimates of the constant term δ 1 (not reported in the paper) were highly significant. Therefore, the misspecification problem for IGARCH with no drift case pointed out by Nelson (1990) does not apply to our case.

References

Baillie RT (1996) Long memory process and fractional integration in econometrics. J Econ 73:5–59

Baillie RT, Bollerslev T (1994) Cointeration, fractional cointegration, and exchange rate dynamics. J Fin 49:37–745

Bollerslev T, Chou R, Kroner K (1992) ARCH Modeling in finance: a review of the theory and empirical evidence. J Econ 52:5–59

Booth GG, Tse Y (1995) Long memory in interest rate futures markets: a fractional cointegration analysis. J Futures Mark 15:573–584

Cheung YW, Lai KS (1993) A fractional cointegration analysis of purchasing power parity. J Bus Econ Stat 11:103–112

Choudhry T (1999) Purchasing power parity in high-inflation Eastern European countries: evidence from fractional and harris-inder cointegration tests. J Macroecon 21:293–308

Cosset J-C (1982) Forward rates as predictors of future interest rates in the Eurocurrency market. J Int Bus Stud 1982:71–83

Dahlhaus R (1989) Efficient parameter estimation for self-similar processes. Ann Stat 17:1749–1766

Dickey DA, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49:1057–1072

Diebold FX, Rudebush G (1991) On the power of Dickey-Fuller tests against fractional alternatives. Econ Lett 35:155–160

Dittmann I (2000) Residual-based tests for fractional cointegration: a Monte Carlo study. J Time Ser Anal 21:615–647

Duffie D, Singleton KJ (2003) Credit risk: pricing, measurement, and management. Princeton University Press, Princeton, NJ

Engle RF (1982) Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50:987–1007

Engle RF, Granger CWJ (1987) Cointegration and error correction: representation, estimation, and testing. Econometrica 55:251–276

Engle RF, Lilien D, Robins R (1987) Estimating time varying risk premia in the term structure: the ARCH-M model. Econometrica 55:391–407

Fox R, Taqqu MS (1986) Large-sample properties of parameter estimates for strongly dependent stationary Gaussian time series. Ann Stat 14:517–532

Fung HG, Isberg SC (1992) The international transmission of Eurodollar and US interest rates: a cointegration analysis. J Bank Fin 16:757–770

Fung H-G, Leung WK (1993) The pricing relationship of Eurodollar futures and eurodollar deposit rates. J Futures Mark 13:115–126

Fung HG, Lo WC (1993) Memory in interest rate futures. The J Futures Mark 13:865–872

Fung HG, Lo WC (1995) An empirical examination of the ex ante international interest rate transmission. Fin Rev 30:175–192

Geweke JF, Porter-Hudak S (1983) The estimation and application of long memory time series models. J Time Ser Anal 1:221–238

Granger CWJ, Joyeux R (1980) An introduction to long-memory time series models and fractional differencing. J Time Ser Anal 1:15–39

Harrison JM, Kreps DM (1979) Martingales and arbitrage in multiperiod securities markets. J Econ Theory 20:381–408

Harrison JM, Pliska SR (1981) Martingales and stochastic integrals in the theory of continuous trading. Stoch Process Appl 11:215–260

Harrison JM, Pliska SR (1983) A stochastic calculus model of continuous trading: complete markets. Stoch Process Appl 15:313–316

Hartman DG (1984) The international financial market and US interest rates. J Int Money and Fin 3:91–103

Hedge SP, MacDonald B (1986) On the informational role of treasury bill futures. J Futures Mark 6:629–643

Hendershott PH (1967) The structure of international interest rates: the U.S. Treasury bill rate and the eurodollar deposit rate. J Fin 22:455–465

Hosking JRM (1981) Fractional differencing. Biometrica 68:165–176

Kaen FR, Hachey GA (1983) Eurocurrency and national money market interest rates: an empirical investigation of causality. J Money Credit and Bank 15:327–338

Kwak S (1971) The structure of international interest rates: an extension of Hendershott's tests. J Fin 36:897–900

Levin JH (1974) The eurodollar market and the international transmission of interest rates. Can J Econ 7:205–224

Lo AW (1991) Long term memory in stock market prices. Econometrica 1279–1313

Lothian JR (2002) The internationalization of money, finance and the globalization of financial markets. J Int Money and Fin 21:699–724

Lumsdaine LR (1996) Consistency and asymptotic normality of the quasi-maximum likelihood estimation in IGARCH(1,1) and covariance stationary GARCH(1,1) models. Econometrica 64:575–596

Mandlebrot B (1972) Statistical methodology for non-periodic cycles: from the covariance to the R/S analysis. Ann Econ Soc Meas 1:259–290

MacDonald SS, Hein S (1989) Futures rates and forward rates as predictors of near-term treasury bill rates. J Futures Mark 3:249–262

Merton RC (1974) On the pricing of corporate debt: the risk structure of interest rates. J Fin 29:449–470

Merton RC (2000) Continuous-time finance, Revised edn., Blackwell Publishers Ltd, Oxford, UK

Nelson DB (1990) Stationarity and persistence in the GARCH(1,1) model. Econometric Theory 6:318–324

Nelson DB (1991) Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59:347–370

Phillips PCB, Perron P (1988) Testing unit roots in time series regression. Biometrica 75:335–346

Schnitzel P (1983) Causality in the euro-dollar growth process. Quart J Bus Econ 3:66–77

Shrestha K, Welch RL (2001) Relationship between expected Treasury bill and Eurodollar interest rates: a fractional cointegration analysis. Rev Quant Fin Account 16:65–80

Sowell F (1990) The fractional unit root distribution. Econometrica 58:495–506

Swanson PE (1988) The international transmission of interest rates: a note on causal relationships between short term external and domestic US dollar returns. J Bank Fin 12:563–573

Walz DT, Spencer RW (1989) The information content of forward rates: further evidence. J Fin Res 12:69–81

Tse Y, Booth G (1995) The relationship between U.S. and Eurodollar interest rates: evidence from the futures market. Weltwirschaftlches Archiv 131:28–46

Tse Y, Booth G (1996) Common volatility spillovers between U.S. and Eurodollar interest rates: evidence from the futures market. J Econ Bus 48:299–312

Vassalou M, Yuhang X (2004) Default risk in equity returns. J Fin 59:831–868

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lee, Cf., Shrestha, K. & Welch, R.L. Relationship between Treasury bills and Eurodollars: Theoretical and Empirical Analyses. Rev Quant Finan Acc 28, 163–185 (2007). https://doi.org/10.1007/s11156-006-0006-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-006-0006-7