Abstract

We explore if fairness and inequality motivations affect cooperation in indefinitely repeated games. Each round, we randomly divided experimental participants into donor–recipient pairs. Donors could make a gift to recipients, and ex-ante earnings are highest when all donors give. Roles were randomly reassigned every period, which induced inequality in ex-post earnings. Theoretically, income-maximizing players do not have to condition on this inequality because it is payoff-irrelevant. Empirically, payoff-irrelevant inequality affected participants’ ability to coordinate on efficient play: donors conditioned gifts on their own past roles and, with inequalities made visible, discriminated against those who were better off.

Similar content being viewed by others

Notes

There is a large literature about how to incorporate fairness and inequality aversion into economic models (e.g., Fehr and Schmidt 1999; Bolton and Ockenfels 2000; Rabin 1993) and although our study is related to it, it is not an experiment about testing these models in the lab (e.g., Deck 2001; Kagel and Willey-Wolfe 2001; Blanco et al. 2011).

This number could also serve as a public coordination device, at the group level.

Subjects had access to a record of their own past outcomes, and also had pen and paper.

The donor observed her blue index, the paired recipient’s index, and the index of the two others in a random order. To facilitate comparisons, the average relative frequency of 0.50 was normalized to 100, so a value of \(100+x\) indicated a \(x\%\) departure from the average.

Full cooperation cannot be ruled out as an equilibrium under empirically reasonable risk aversion. The coefficient \(\beta ^*\) depends on the assumption of linear preferences. One can show that with CRRA preferences of the type \(u^{1-\gamma }/(1-\gamma )\) full cooperation remains an equilibrium if \(\gamma \le 0.37\). Estimates of CRRA coefficients vary widely depending on many factors; in experiments with a fixed recruitment fee, such as ours, we find a coefficient of 0.34 (Harrison et al. 2009), while in experiments with low stakes 60% of subjects lay below 0.41 (Holt and Laury 2002).

For a continuous variable, the marginal effect measures the change in the likelihood to cooperate for an infinitesimal change of the independent variable. For a dummy variable, the marginal effect measures the change in the likelihood to cooperate for a discrete change of the dummy variable from its base level (0).

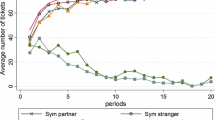

Cooperation increased over the first three supergames, and then stabilized. In a regression with a factor variable tracing the impact of each supergame we can reject the hypothesis that the coefficient on supergame 2 is statistically similar to those on supergames 4 and 5. All other pairwise coefficient comparisons indicate statistical similarity in coefficients (p value ranges from 0.541 to 0.829).

The inclusion of the cutoff point 100 in the advantaged definition implies we have less than 50% disadvantaged subjects in the data. Overall, 41% of subjects can be classified as disadvantaged and 59% as advantaged. For example, in round 9 of Baseline, the average subject has been a recipient in 4 of the previous 8 rounds; a subject who was a recipient in less than 4 rounds would have a blue index below 100 and would be classified as disadvantaged. Table B2 in Supplementary Information reports the distribution of the four possible types of meetings for all treatments pooled together.

The sum of the coefficients on Grim trigger and each choice dummy identifies the average donor’s reaction to a defection in her group, on the first and second occasion she had to react. The Grim trigger coefficient captures the long-run response. Subjects made choices at random points in time so these regressors trace an individual’s behavior on the first two occasions in which she can make a choice, after suffering or observing an initial defection. As subjects were donors on average every two rounds, this traces the subjects’ response between two and four rounds after the defection. Empirically, the first opportunity to react to an observed defection occurs, on average, in round 4. For a detailed discussion on this econometric technique see Camera and Casari (2014).

The regressions account for the lack of independence within a session. Statistical analysis based on aggregating data at the session level gives us only four independent observations per treatment and is unsurprisingly inconclusive (data not reported).

Table B1 in Supplementary Information reports statistics on inequality in opportunities experienced by donors, and its evolution over the supergame.

One observation is the Gini measure for one group in a supergame (\(N=80\) per treatment); income is measured as the average payoff of a subject in a supergame. Income exhibits a higher degree of inequality than in counterfactual simulations were roles alternate as in the experiment but choices are imposed. The average Gini for income is around 0.02 in the counterfactual full-defection outcome, and around 0.11 in the counterfactual full-cooperation outcome.

We also see that the coefficient on the AD regressor is statistically zero, which means that donors behaved similarly in AA and AD meetings. One may think that advantaged donors would have lowered cooperation with disadvantaged players, as a way to punish for discriminating them. Our design hinders this kind of negative reciprocity. While donors saw the recipient’s index, the converse is not true, which is probably a reason why advantaged donors did not discriminate against the disadvantaged.

In Roles, subjects also saw the past roles of the other two group members, but did not condition on this information. When we add a covariate that controls for the donor’s ranking in the distribution of roles (top, bottom or neutral), we find an insignificant impact on the cooperation probability; see col. 2 in Table B3 in Supplementary Information.

A regression based on Model 1 in Table 7, where the unit of observation is one group in a supergame (\(\hbox {N}=80\) per treatment), confirms this lack of significance; see column 1 in Table B4 in the Supplementary Information. A logit regression based on Model 2 in Table 7 show a significant decline of full cooperation in the History treatment, but not in the Wealth treatment; see column 2 in Table B4 in Supplementary Information.

In Table 11, the coefficient on the Grim trigger regressor is negative and highly significant, the sums of this coefficient and each of the Choice n coefficients are also negative and significant, meaning that the decline in cooperation was long-lasting.

We calculated counterfactual ex-post payoffs for each subject, under full cooperation and full defection, using the realized sequences of roles. Full cooperation would have benefited about 90% of subjects, roughly doubling their payoff (on average, 4.2 points/round gained vs. 8.6 realized in the experiment—all treatments combined). The rest would have lost 1.3 points (vs. 11.4 points realized). Full defection would have generated a slight ex-post payoff increment (0.8 points/round) for about 10% of players—those with especially long donor sequences, and created a 4.4 points average loss for everyone else.

About 55% of subjects were males, and the rest female. The subject pool is composed of about \(90\%\) undergraduate students with the remainder being primarily graduate students although some faculty, staff, and non-university associated people are in the pool. We include sex differences as controls in the econometric analysis.

References

Abreu, D., Pierce, D., & Stacchetti, E. (1990). Toward a theory of discounted repeated games with imperfect monitoring. Econometrica, 58, 1041–1063.

Aghion, P., & Williamson, J. (1998). Growth, inequality, and globalization. New York: Cambridge University Press.

Anderson, L. R., Mellor, J. M., & Milyo, J. (2006). Induced heterogeneity in trust experiments. Experimental Economics, 9, 223–235.

Andreoni, J., & Varian, H. (1999). Preplay contracting in the Prisoners’ Dilemma. Proceedings of the National Academy of Sciences of the United States of America, 96(19), 10933–10938.

Bigoni, M., Camera, G., & Casari, M. (2018). Partners or strangers? Cooperation, monetary trade, and the choice of scale of interaction. American Economic Journal: Microeconomics, 3, 164.

Blanco, M., Engelmann, D., & Normann, H. T. (2011). A within-subject analysis of other-regarding preferences. Games and Economic Behavior, 72(2), 321–338.

Bolton, G. E., & Ockenfels, A. (2000). ERC: A theory of equity, reciprocity and competition. American Economic Review, 90, 166–193.

Camera, G., & Casari, M. (2009). Cooperation among strangers under the shadow of the future. The American Economic Review, 99(3), 979–1005.

Camera, G., & Casari, M. (2014). The coordination value of monetary exchange: Experimental evidence. American Economic Journal: Microeconomics, 6(1), 290–314.

Camera, G., Casari, M., & Bigoni, M. (2013). Money and trust among strangers. Proceedings of the National Academy of Sciences of the United States of America, 110(37), 14889–14893.

Dal Bó, P. (2005). Cooperation under the shadow of the future: Experimental evidence from infinitely repeated games. American Economic Review, 95(5), 1591–1604.

Dal Bó, P., & Fréchette, G. (2018). On the determinants of cooperation in infinitely repeated games: A survey. Journal of Economic Literature, 56(1), 60–114.

Deck, C. (2001). A test of game theoretic and behavioral models of play in exchange and insurance environments. American Economic Review, 91(5), 1546–1555.

Ellison, G. (1994). Cooperation in the prisoner’s dilemma with anonymous random matching. Review of Economic Studies, 61, 567–588.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. Quarterly Journal of Economics, 114(3), 817–868.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Gangadharan, L., Nikiforakis, N., & Villeval, M. C. (2015). Equality concerns and the limits of self-governance in heterogeneous populations. IZA Discussion Papers, No. 9384.

Goeree, J. K., & Holt, C. A. (2000). Asymmetric inequality aversion and noisy behavior in alternating-offer bargaining games. European Economic Review, 44(4), 1079–1089.

Greiner, B., Ockenfels, A., & Werner, P. (2012). The dynamic interplay of inequality and trust—An experimental study. Journal of Economic Behavior and Organization, 81, 355–365.

Güth, W., Kliemt, H., & Ockenfels, A. (2003). Fairness versus efficiency: An experimental study of (mutual) gift giving. Journal of Economic Behavior and Organization, 50(4), 465–475.

Harrison, G. W., Laub, M. I., & Rutström, E. E. (2009). Risk attitudes, randomization to treatment, and self-selection into experiments. Journal of Economic Behavior and Organization, 70(3), 498–507.

Harsanyi, John C., & Reinhard, Selten. (1988). A general theory of equilibrium selection in games. Cambridge: MIT Press.

Haushofer, Johannes, & Fehr, Ernst. (2014). On the psychology of poverty. Science, 344(6186), 862–867.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 92(5), 1644–1655.

Kagel, J. H., & Willey-Wolfe, K. (2001). Tests of fairness models based on equity considerations in a three-person ultimatum game. Experimental Economics, 4(3), 203–219.

Kandori, M. (1992). Social norms and community enforcement. Review of Economic Studies, 59, 63–80.

Konow, J. (2000). Fair shares: Accountability and cognitive dissonance in allocation decisions. American Economic Review, 90, 1072–1091.

Loch, C. H., & Wu, Y. (2008). Social preferences and supply chain performance: An experimental study. Management Science, 54(11), 1835–1849.

Mollerstrom, J., Reme, B., & Sørensen, Erik. (2015). Luck, choice and responsibility—An experimental study of fairness views. Journal of Public Economics, 131, 33–40.

Nishi, A., Shirado, H., Rand, D. G., & Christakis, N. A. (2015). Inequality and visibility of wealth in experimental social networks. Nature, 526, 426.

O’Reilly, Charles A. (1980). Individuals and information overload in organizations: Is more necessarily better? The Academy of Management Journal, 23(4), 684–696.

Palfrey, T. R., & Rosenthal, H. (1994). Repeated play, cooperation and coordination: An experimental study. The Review of Economic Studies, 61(3), 545–565.

Piketty, T. (2014). Capital in the twenty-first century. Cambridge: Harvard University Press.

Putnam, R. (2000). Bowling alone: The collapse and revival of American community. New York: Simon and Schuster.

Rabin, M. (1993). Incorporating fairness into game theory and economics. American Economic Review, 83, 1281–1302.

Roth, A. E., & Murnighan, K. (1978). Equilibrium behavior and repeated play of the prisoner’s dilemma. Journal of Mathematical Psychology, 17, 189–198.

Sadrieh, A., & Verbon, H. A. (2006). Inequality, cooperation, and growth: An experimental study. European Economic Review, 50, 1197–1222.

Sherstyuk, K., Tarui, N., & Saijo, T. (2013). Payment schemes in infinite-horizon experimental games. Experimental Economics, 16(1), 125–153.

Smith, V. (1994). Economics in the laboratory. Journal of Economic Perspectives, 8(1), 113–131.

Sonnemans, J., Schram, A., & Offerman, T. (1999). Strategic behavior in public good games: When partners drift apart. Economics Letters, 62, 35–41.

Stiglitz, J. E. (2012). The price of inequality: How today’s divided society endangers our future. New York: W. W. Norton & Company.

Tavoni, A., Dannenberg, A., Kallis, G., & Löschel, A. (2011). Inequality, communication, and the avoidance of disastrous climate change in a public goods game. Proceedings of the National Academy of Sciences of the United States of America, 108(29), 11825–11829.

Troutman, C. M., & Shanteau, J. (1977). Inferences based on nondiagnostic information. Organizational Behavior and Human Performance, 19, 43–55.

Acknowledgments

We thank Co-Editor M. C. Villeval and two anonymous referees for helpful suggestions that improved this study from an earlier version. We also thank N. Wilcox for helpful conversations, K. Bregu for help running the experiments and seminar participants at Chapman University, the Federal Reserve Bank of Cleveland, Humboldt University, the University of Basel, and the Theory and Experiments in Monetary Economics Conference at GMU. G. Camera acknowledges partial research support through the NSF Grant CCF-1101627.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix A

Appendix A

1.1 Procedural details

We recruited 256 subjects through announcements to the standing subject pool for the Behavioral Business Research Laboratory at the University of Arkansas. No subject had previous experience with this type of game in the lab.Footnote 19 After giving informed consent, subjects were seated at private terminals. Neither communication nor eye contact was possible among subjects at any time during the session. The experimenter publicly read the paper instructions at the start of the experiment, a copy of which were then left on the subjects’ desks. The experiment was programmed and conducted with the software z-Tree (Fischbacher 2007). On average, a session lasted 94 rounds for a running time of about 120 minutes including instructions, a paid post-instruction comprehension quiz, and post-experiment payment. Average earnings were $27.00 per subject (\(\min =\$6.50, \max = \$55.50\)) excluding a \(\$5\) fixed participation payment and an average of \(\$2.10\) (\(\min =\$.75, \max = \$2.50\)) from providing correct answers to the comprehension quiz (\(\$0.25\) for each correct answer out of 10 questions). Only one randomly selected supergame from the session was paid and subjects knew this fact in advance.

1.2 Proof of Proposition 1

This analysis is based on the existence of equilibrium proof in Camera et al. (2013). In each round \(t=0,1,2\ldots\) individuals in the group are matched in pairs, with uniform probability of selection. In each pair, a computer randomly determines who is the donor and who is the recipient (with equal probability). If cooperation (=Help) is the outcome, then g is the payoff to the recipient and for generality let a denote the payoff to the donor. If defection (=Do nothing) is the outcome, then d is the payoff to the donor and \(d-l\) to the recipient. Round payoffs are geometrically discounted at rate \(\beta \in (0,1)\) starting from round \(n \ge 0\).

The equilibrium payoff (=expected lifetime utility) at \(t=0\) is

A player is a donor or a recipient with equal probability in each round, hence expects to earn \(\dfrac{g+a}{2}\) in each round. The payoff v(n) is increasing in n because payoffs are discounted by \(\beta\) in rounds \(t\ge n\).

The equilibrium payoff in the continuation game starting on any date \(t\ge 0\), before any uncertainty is resolved, corresponds to

The equilibrium payoff of a donor at the start of any date t is

We must check that in equilibrium donors have no incentive to defect; out of equilibrium, donors have no incentive to cooperate.

Defection is the dominant action off-equilibrium; i.e., it is always individually optimal to punish after a defection from equilibrium play is made public. To see this suppose a donor deviates by cooperating off equilibrium. She would earn a instead of d but her continuation payoff would not improve since everyone else keeps defecting—as prescribed by the rule of punishment. Since \(d>a\), it is optimal to punish off equilibrium.

In equilibrium, cooperation is a best response in every round \(t=0,1,\ldots\), if \(V_{dt} \ge \hat{V}_{dt}\). The left-hand-side denotes the payoff to a donor who cooperates; the right-hand-side denotes the donor’s payoff when she moves off equilibrium under a one-time deviation. Such deviation is publicly observed, hence—when everyone follows the cooperative strategy—every donor will always defect in the future. The payoff to the deviator is thus

Now define

The minimum value of \(\Delta _t\) is achieved for \(t \ge n\). The implication is that cooperation is individually optimal in all rounds t whenever

1.3 The grim strategy is risk dominant

Our game is sequential, does not have a two-by-two structure, and admits more than two equilibria. Therefore, we consider a notion of risk dominance that departs from the standard formalization in Harsanyi and Reinhard (1988), but conforms to the heuristic argument that motivates it. A risk-dominant equilibrium maximizes the expected payoff when players have uniformly distributed second order beliefs on the best and worst equilibrium (full cooperation and full defection). We also add structure to beliefs about strategies play, by exploiting the dynamic structure of the game. In doing so, we employ the technique in Bigoni et al. (2018), to which we refer the reader.

Given random role alternation, the ex-ante expected payoff under full defection equilibrium is denoted

The ex-ante expected payoff under full cooperation is

Consider uncertainty over two competing strategies: “grim” (G) and “always defect” (AD). Initial donors select a strategy in round 1 and maintain it for the rest of the supergame. Initial recipients take no action in round 1, so we set them free to select G or AD in round 2. Given public monitoring, conjecture that those who choose strategy in round 2 coordinate their choices by best responding to the strategy play observed in round 1. If so, then all uncertainty about future play is resolved at the end of round 1 as if initial donors selected the equilibrium. G dominates AD after any history of play, for those who choose their strategy in round 2 (weakly dominates AD, if someone defected in round 1). Hence, if no-one (someone) defected in round 1, then every donor will cooperate (defect) in every future meeting.

Consider round 1. There is strategic uncertainty because an initial producer is not sure what strategy the other initial producers will select. Suppose that every initial producer believes that in round 1 there is probability p that C is the outcome in any given pair; D is the outcome with the complementary probability. A special case is \(p=1/2\), which may be motivated by the “principle of insufficient reason” for a player who is unsure about what the others will do. That is, the individual believes that the other initial producer plays G with probability p, and AD otherwise. At the end of round 1 either C will be the outcome in every future meeting, or D will be the outcome in every future meeting.

Fix an initial donor. Let denote \(V_G\) and \(V_{AD}\) the expected utilities from choosing strategy G and AD where

Consider \(V_{AD}\): the initial donor defects so all future donors will defect whether or not they chose G or AD. Consider \(V_G\): with probability p the other initial donor is also a grim player. In that case both cooperate and there is full cooperation forever so the continuation payoff is \(\beta v\). With probability \(1-p\) the other initial donor plays AD in which case the continuation payoff is \(\beta \hat{v}\) because full defection ensues. We say that G is risk dominant if \(V_G \ge V_{AD}\). If \(p=0.5\), which is a standard consideration, this implies

Therefore grim trigger is a risk-dominant strategy in our experiment since the discount factor is 0.75.

Rights and permissions

About this article

Cite this article

Camera, G., Deck, C. & Porter, D. Do economic inequalities affect long-run cooperation and prosperity?. Exp Econ 23, 53–83 (2020). https://doi.org/10.1007/s10683-019-09610-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-019-09610-5