Abstract

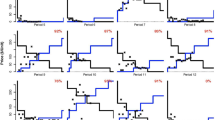

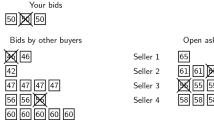

Auctions that require advance production increase seller costs because inventories must be held. This cost does not exist in production-to-demand markets for which production follows trading, and sales exactly match quantities produced. Data from laboratory computerized double auction markets show that advance-production prices are significantly higher and quantities traded are significantly lower than they are in production-to-demand auctions. Price convergence patterns show advance-production sellers moving toward 9% higher prices and 22% greater earnings.

Similar content being viewed by others

References

Ashenfelter, O., Currie, J., Farber, H.S., and Spiegel, M. (1992). “An Experimental Investigation of Dispute Rates in Alternative Arbitration Systems.” Econometrica. 60(6), 1407–1433.

Davis, D.D. (1999). “Advance Production and Cournot Outcomes: An Experimental Investigation.” Journal of Economic Behavior and Organization. 40, 59–79.

Kagel, J.H. (1995). “Auctions: A Survey of Current Research.” In J.H. Kagel and A.E. Roth (eds.), The Handbook of Experimental Economics. Princeton, NJ: Princeton University Press.

Mestelman, S. and Welland, D. (1987). “Advance Production in Oral Double Auction Markets.” Economic Letters. 23, 43–48.

Mestelman, S. and Welland, D. (1988). “Advance Production in Experimental Markets.” Review of Economic Studies. 55, 641–654.

Mestelman, S. and Welland, D. (1991a). “The Effects of Rent Asymmetries in Markets Characterized By Advance Production: A Comparison of Trading Institutions.” Journal of Economic Behavior and Organization. 15, 387–405.

Mestelman, S. and Welland, J.D. (1991b). “Inventory Carryover and the Performance of Alternative Market Institutions.” Southern Economic Journal. 57, 1024–1042.

Mestelman, S., Welland, D., and Welland, D. (1987). “Advance Production in Posted Offer Markets.” Journal of Economic Behavior and Organization. 8, 249–264.

Noussair, C.N., Plott, C.R., and Riezman, R.G. (1995). “An Experimental Investigation of the Patterns of International Trade.” American Economic Review. 85(3), 462–491.

Parks, R.W. (1967). “Efficient Estimation of a System of Regression Equations When Disturbances are Both Serially and Contemporaneously Correlated.” Journal of the American Statistical Association. 62, 500–509.

Phillips, O.R. and Menkhaus, D.J. (2001). “Random Shocks in Experimental Spot and Forward Auction Markets.” Quarterly Review of Economics and Finance. 41, 545–560.

Smith, V.L. (1962). “An Experimental Study of Competitive Market Behavior.” Journal of Political Economy. 70, 111–137.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Phillips, O.R., Menkhaus, D.J. & Krogmeier, J.L. Laboratory Behavior in Spot and Forward Auction Markets. Experimental Economics 4, 243–256 (2001). https://doi.org/10.1023/A:1013269304544

Issue Date:

DOI: https://doi.org/10.1023/A:1013269304544