Abstract

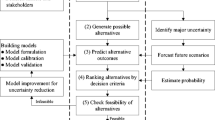

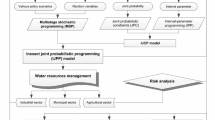

The presence of uncertainties in assessing benefits and costs detracts from deterministic economic evaluation. This paper examines three probabilistic economic evaluation procedures: stochastic dominance, expected gain-confidence limit, and Hurwicz criterion. Their relative performances are evaluated through an example. Furthermore, the paper investigates the effects of (1) distributional assumptions of benefit and cost items, (2) uncertainty in project life, and (3) distribution of net present value on the project selection.

Similar content being viewed by others

References

Barnes, J. W., Zinn, C. D., and Eldred, B. S.: 1978, A methodology for obtaining the probability density function of the present worth of probabilistic cash flow profiles,AIIE Trans. 10(3), 226–236.

Baumol, W. J.: 1963, An expected gain-confidence limit criterion for portfolio selection,Management Sci. 10, 174–182.

Bey, R. P.: 1981, The inpact of stochastic project lives on capital budgeting decisions, in R. L. Crum and F. G. J. Derkinderen. (eds.),Capital Budgeting Under Conditions of Uncertainty, Martinus Nijhoff, Boston.

Buck, J. R. and Askin, R. G.: 1986, Partial means in the economic risk analysis of projects,The Engineering Economists 31(3), 189–212.

Bunn, D. W.: 1984,Applied Decision Analysis, McGraw-Hill, New York.

Canada, J. R. and White, J. A.: 1980.Capital Investment Decision Analysis for Management and Engineering, Prentice-Hall, Englewood Cliffs, NJ.

Chen, K. C. W. and Manes, R. P., 1986: A note on Bias in capital budgeting introduced by stochastic life,The Engineering Economist 31(2), 165–174.

El-Ramly, N. A., Peterson, R. E., and Seo, K. K.: 1975, Economic comparison of projects incorporating decision theory and the expected gain-confidence limit criterion,The Engineering Economists 20(1), 61–69.

Grigg, N. S.: 1985,Water Resources Planning, McGraw-Hill, New York.

LaCava, G. J.: 1976, Improving the mean-variance criterion using stochastic dominance,Decision Sci. 7, 29–39.

Markowitz, H.: 1959,Portfolio Selection, Wiley, New York.

Porter, R. B. and Carey, K.: 1974, Stochastic dominance as a risk analysis criterion,Decision Sci. 5, 11–21.

Taha, H. A.: 1976,Operations Research: An Introduction, 2nd edn., MacMillan, New York.

Tufekci, S. and Young, D. B.: 1987, Moments of the present worth of general probabilistic cash flows under random timing,The Engineering Economist 32(4), 303–336.

Tung, Y. K., Wang, P. Y., and Yang, J. C.: 1993, Water resources projects evaluation and ranking under economic uncertainty,J. Water Resour. Mgmt. 7, 311–333.

Van Horne, J. C.: 1972, Capital budgeting under conditions of uncertainty as to project life,The Engineering Economist,17(3), 189–199.

Young, D. B. and Contreras, L. E.: 1975, Expected present worths of cash flows under uncertain timing,The Engineering Economist,20(4), 257–268.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Tung, YK., Yang, JC. Probabilistic evaluations of economic merit of water resource projects. Water Resour Manage 8, 203–223 (1994). https://doi.org/10.1007/BF00877087

Received:

Issue Date:

DOI: https://doi.org/10.1007/BF00877087