Abstract

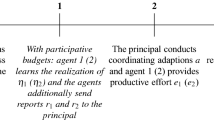

While accounting textbooks emphasize the roles of budgeting in controlling and coordinating agents' activities, the principal-agent literature has focused primarily on the control aspect. Recent papers have studied the coordination aspect of budgeting in settings in which the agents are technologically dependent (sequential or joint production is considered). In this article, we develop a role for budgeting in coordination, despite the agents being technologically independent (individual production is considered). In our model, the principal uses relative performance evaluation to extract information rents from the agents. However, the use of relative performance evaluation results in a multiple equilibria (tacit collusion) problem. The value of budgeting procedures is derived from their ability to coordinate the agents to arrive at the right equilibrium.

Similar content being viewed by others

References

AbreuD., and H.Matsushima. (1992). “Virtual Implementation in Iteratively Undominated Strategies: Complete Information”.Econometrica 60, 993–1008.

AryaA., and J.Glover. (1995). “A Simple Forecasting Mechanism for Moral Hazard Settings”,Journal of Economic Theory 66, 507–521.

AryaA., J.Glover, and R.Young. (1995). “Virtual Implementation in Separable Bayesian Environments Using Simple Mechanisms”.Games and Economic Behavior 9, 127–138.

BaimanS., and H.Evans. (1983). “Pre-decision Information and Participative Management Control Systems”.Journal of Accounting Research 21, 371–395.

Becker, S., and D. Green. (1962). “Budgeting and Employee Behavior”.Journal of Business, 392–402.

BernheimB. (1984). “Rationalizable Strategic Behavior”.Econometrica 52, 1007–1028.

ChristensenJ. (1982). “The Determination of Performance Standards and Participation”.Journal of Accounting Research 20, 589–603.

Cyert, R., and Y. Ijiri. (1974). “A Framework for Developing the Objectives of Financial Statements”. In J. J. Cramer, Jr. and G. H. Sorter (eds.),Objectives of Financial Statements 2. AICPA.

DemskiJ., and D.Sappington. (1984). “Optimal Incentive Contracts with Multiple Agents”,Journal of Economic Theory 33, 152–171.

Fischer, P., and J. Hughes. (1995). “Mutual Monitoring and Best Agency Contracts”. Working paper, Duke University.

FudenbergD., and J.Tirole. (1993).Game Theory. Cambridge, MA: MIT Press.

GibbardA. (1973). “Manipulation of Voting Schemes: A General Result”.Econometrica 41, 587–602.

GloverJ. (1994). “A Simpler Mechanism That Stops Agents from Cheating”Journal of Economic Theory 62, 221–229.

HofstedeG. (1968).The Game of Budget and Control. New York: Barnes and Noble.

HorngrenC., G.Foster, and S.Datar. (1994).Cost Accounting: A Managerial Emphasis. Englewood Cliffs: Prentice-Hall.

IjiriY. (1975).Theory of Accounting Measurement. Sarasota: American Accounting Association.

JacksonM. (1991). “Bayesian Implementation”.Econometrica 59, 461–477.

JacksonM. (1992). “Implementation in Undominated Strategies: A Look at Bounded Mechanisms”.Review of Economic Studies 59, 757–775.

JacksonM., T.Palfrey, and S.Srivastava. (1994). “Undominated Nash Implementation in Bounded Mechanisms”.Games and Economic Behavior 6, 474–501.

JordanJ., and G.Harris. (1920).Cost Accounting. New York: Ronald Press.

KanodiaC. (1993). “Participative Budgets as Coordination and Motivational Devices”.Journal of Accounting Research 31, 172–189.

KrepsD. (1990).A Course in Microeconomic Theory. Princeton: Princeton University Press.

MaC., J.Moore, and S.Turnbull. (1988). “Stopping Agents from Cheating”.Journal of Economic Theory 46, 355–372.

MageeR. (1986).Advanced Managerial Accounting. New York: Harper & Row.

MaherM., and E.Deakin. (1994).Cost Accounting. Boston: Irwin.

Maskin, E. (1977). “Nash Equilibrium and Welfare Optimality”. Working paper, Massachusettes Institute of Technology.

MelumadN., and S.Reichelstein. (1989). “Value of Communication in Agencies”.Journal of Economic Theory 47, 334–368.

MookherjeeD., and S.Reichelstein. (1990). “Implementation via Augmented Revelation Mechanisms”.Review of Economic Studies 57, 453–476.

MookherjeeD., and S.Reichelstein. (1992). “Dominant Strategy Implementation of Bayesian Incentive Compatible Allocation Rules”.Journal of Economic Theory 56, 378–399.

Mookherjee, D., and S. Reichelstein. (1994). “Budgeting and Hierarchical Control”. Working paper, University of California at Berkeley.

MooreJ. (1992). “Implementation, Contracts, and Renegotiation in Environments with Complete Information”. In J. J.Laffont (ed.),Advances in Economic Theory: Sixth World Congress 1. Cambridge: Cambridge University Press.

MyersonR. (1979). “Incentive Compatibility and the Bargaining Problem”.Econometrica 47, 61–74.

PalfreyT., and S.Srivastava. (1989). “Implementation with Incomplete Information in Exchange Economies”.Econometrica 57, 115–134.

PalfreyT., and S.Srivastava. (1991). “Nash Implementation Using Undominated Strategies”.Econometrica 59, 479–501.

PalfreyT., and S.Srivastava. (1993).Bayesian Implementation. Chur: Harwood.

PearceD. (1984). “Rationalizable Strategic Behavior and the Problem of Perfection”.Econometrica 52, 1029–1050.

PennoM. (1984). “Asymmetry of Pre-decision Information and Managerial Accounting”.Journal of Accounting Research 22, 177–191.

PostlewaiteA., and D.Schmeidler. (1986). “Implementation in Differential Information Economies”.Journal of Economic Theory 39, 14–33.

RajanM. (1992). “Cost Allocation in Multiagent Setting”.The Accounting Review 67, 527–545.

SandersT. (1934).Cost Accounting for Control. New York: McGraw-Hill.

SatterthwaiteM. (1975). “Strategy-Proofness and Arrow's Conditions: Existence and Correspondence Theorems for Voting Procedures and Social Welfare Functions”.Journal of Economic Theory 10, 187–217.

SeltenR. (1975). “Reexamination of the Perfectness Concept for Equilibrium Points in Extensive Form Games”.International Journal of Game Theory 4, 25–55.

SjöströmT. (1994). “Implementation in Undominated Nash Equilibria Without Integer Games”.Games and Economic Behavior 6, 502–511.

StedryA. (1960).Budget Control and Cost-Behavior. Chicago: Markham.

VatterW. (1950).Managerial Accounting. New York: Prentice-Hall.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Arya, A., Glover, J. The role of budgeting in eliminating tacit collusion. Rev Acc Stud 1, 191–205 (1996). https://doi.org/10.1007/BF00555371

Issue Date:

DOI: https://doi.org/10.1007/BF00555371